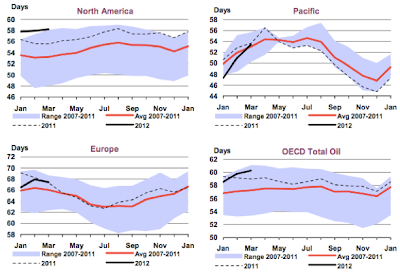

If this were true, we'd expect it to show up as oil inventories getting tight (as current demand was out of line with prices being reduced by feared future collapse in demand). The data on global oil stocks are highly imperfect - they only extend to the OECD, and they are generally several months behind. Such as they are, the graph above (from the May IEA OMR and expressed as days of demand) shows the picture. It does not appear to be consistent with the hypothesis above - stocks are very high in the US (presumably a continuation of the WTI-Brent anomaly), and normal to above average elsewhere. The data extend through the end of March.

That leads me to question the idea that global oil demand is growing in 2012. Roughly speaking my reasoning for thinking that it would be is:

- The US economy is still growing (albeit sluggishly)

- Europe is contracting (but only very mildly)

- Asia is still growing strongly (albeit not at quite as insane a rate as in recent years).

- On balance, then, the global economy must still be growing.

- Generally, when the economy is growing, oil demand grows.

Of course, it's also possible that OECD stocks through March paint a misleading picture - the OECD is only half of global demand these days; maybe the other half is doing something else altogether, and maybe the picture changed substantially in April and May - after all, that's when the price drop mainly happened:

More to follow, I'm sure, as I remain a bit mystified.

5 comments:

Is it possible that an increase in use of non-petroleum energy sources like coal and natural gas (or even renewables, I guess) is serving to weaken the linkage between economic growth and petroleum demand?

Perhaps the price of oil is reflecting the state of the credit markets (sort of like the price of housing) more than the demand for delivery?

Well, an excellent analysis of where the energy demand is hiding in a growing world economy.

My answer is simple: The measurement and the method of measuring economy is - wrong.

Not wrong in everything but in the meta view.

That part of the GDP-measured economy which is "created" by the financial sector is not part of any real economy.

That part has to be taken out of GDP measurement.

If you take that part of the total GDP out of the calculation of the total sum of te GDP, you get a shrinking real economy.

And that is excactly what you wanted to have as an answer.

Maybe many economists think this is stupid.

But it is not - it is the only way to measure GDP.

FT Alphaville thinks the oil price is manipulated by corporates that want to keep it high to maintain an impression of "artificial scarcity".

It's part of a series where they basically argue there are no resource constraints and we're in for an age of abundance.

I'm finding really hard to wrap my head around that, as resource scarcity seems very real and not at all balanced by efficiency as they argue.

http://ftalphaville.ft.com/blog/2012/06/20/1052641/scarcity-amid-plenty-oil-edition/

Could this possibly help to boost the economy in the US? I think you should watch the video, "Oil Prices Plunge - Good For The Economy?" by Ed Butowsky when he joined the Fox News' Your World with Neil Cavuto.

Post a Comment