Friday, December 31, 2010

Thursday, December 30, 2010

Wednesday, December 29, 2010

Tuesday, December 28, 2010

Prospects for Early Progress in Decarbonizing my Household

As regular readers of this blog know, part of the thinking around my move to upstate New York was to put my family in a position to move to a zero-carbon, or carbon-negative, lifestyle. The goal here is to do this in a way that a) preserves or enhances our quality of life, but b) doesn't cheat.

The point of preserving our quality of life is so that there's some prospect of influencing others to follow us, and most people being highly motivated by their own comfort and convenience, we will be more influential to the extent we don't sacrifice too much of our own. So this is not an effort at voluntary poverty, but rather an effort to figure out how to live a pretty comfortable middle class life while not using fossil fuels.

The point of preserving our quality of life is so that there's some prospect of influencing others to follow us, and most people being highly motivated by their own comfort and convenience, we will be more influential to the extent we don't sacrifice too much of our own. So this is not an effort at voluntary poverty, but rather an effort to figure out how to live a pretty comfortable middle class life while not using fossil fuels.

Labels:

*

Monday, December 27, 2010

Krugman: Peak Oil has Arrived

His exact words are:

In particular, today, as in 2007-2008, the primary driving force behind rising commodity prices isn’t demand from the United States. It’s demand from China and other emerging economies. As more and more people in formerly poor nations are entering the global middle class, they’re beginning to drive cars and eat meat, placing growing pressure on world oil and food supplies.Emphasis mine. I would have worded it a bit differently: with a nuance here and a caveat there, but I think the broad thrust of what he's saying is helpful. It's good to see such a widely followed voice acknowledging these issues. I think the degree of political strain is going to be somewhat greater than he's yet acknowledging though.

And those supplies aren’t keeping pace. Conventional oil production has been flat for four years; in that sense, at least, peak oil has arrived. True, alternative sources, like oil from Canada’s tar sands, have continued to grow. But these alternative sources come at relatively high cost, both monetary and environmental.

Also, over the past year, extreme weather — especially severe heat and drought in some important agricultural regions — played an important role in driving up food prices. And, yes, there’s every reason to believe that climate change is making such weather episodes more common.

So what are the implications of the recent rise in commodity prices? It is, as I said, a sign that we’re living in a finite world, one in which resource constraints are becoming increasingly binding. This won’t bring an end to economic growth, let alone a descent into Mad Max-style collapse. It will require that we gradually change the way we live, adapting our economy and our lifestyles to the reality of more expensive resources.

Saturday, December 25, 2010

Happy Holidays!

Merry Xmas, or other seasonal festivity of your choice!

Regular blogging schedule will resume on Monday. In the meantime, feel free to use this as an open thread for anything in need of discussion or report.

Wednesday, December 22, 2010

A Few Notes on Winter Cycling in the Northeast

Yesterday's post reminds me that I meant to say a few words about cycling in winter here, mostly for the benefit of any other Californians reverse-migrating to the North East in pursuit of better housing options (or whatever other reason you might have). I sold my car when I left California in July and since I have been a) wanting to get a house before a car, and b) holding out for a Volt, I have continued to cycle as my main transportation. Now that I have made it through the solstice, it seems I might have enough of the season under my belt to have some initial clue what it means to cycle here in the winter. Even after I get a car, I anticipate continuing to cycle for exercise.

The good news here is that it's entirely possible to cycle through the winter in Ithaca in reasonable comfort. However, it does require some significant investment in clothing and gear, and it takes longer to transition from inside to outside.

The good news here is that it's entirely possible to cycle through the winter in Ithaca in reasonable comfort. However, it does require some significant investment in clothing and gear, and it takes longer to transition from inside to outside.

Labels:

cycling

Tuesday, December 21, 2010

Friday, December 17, 2010

Thursday, December 16, 2010

Wednesday, December 15, 2010

Tuesday, December 14, 2010

Monday, December 13, 2010

Friday, December 10, 2010

Thursday, December 9, 2010

Wednesday, December 8, 2010

Some Musings On the Bradley Manning Charges

The things that Bradley Manning is currently charged with are here. The essence of it is that between Nov 2009 and May 2010, he used his access to the US classified secret network (SIPRnet) to download a number of things, move them to his personal unclassified computer, and then give them to other unauthorized parties (presumably including Wikileaks). The things he is is accused of thus misusing include:

For the purposes of this discussion, let's assume that he did these things, or at a minimum, that his position as a military analyst in Iraq, and his resulting access to SIPRnet, made it possible that he could have done these things. There is also no indication at this time that Manning had any advanced hacking skills - all the coverage I've read indicates that he just downloaded this stuff and burned it onto CDs. Let's assume that's true also.

- a classified video of a military operation in Baghdad

- a classified PowerPoint video

- more than 150,000 state department cables

For the purposes of this discussion, let's assume that he did these things, or at a minimum, that his position as a military analyst in Iraq, and his resulting access to SIPRnet, made it possible that he could have done these things. There is also no indication at this time that Manning had any advanced hacking skills - all the coverage I've read indicates that he just downloaded this stuff and burned it onto CDs. Let's assume that's true also.

Labels:

bradley manning,

cyberwar,

united states,

wikileaks

Tuesday, December 7, 2010

Friday, December 3, 2010

Thursday, December 2, 2010

Wednesday, December 1, 2010

Tuesday, November 30, 2010

Monday, November 29, 2010

Wikileaks Latest

I spent the early morning hours catching up on the fascinating revelations resulting from the latest efforts of Wikileaks, which involved publishing a quarter of a million US diplomatic cables. (See NYT coverage here, and Guardian here). Obviously, the fallout from this incident will be going on for quite some time. A few quick reactions:

Thursday, November 25, 2010

Happy Thanksgiving

Best wishes to all readers and commenters!

Posting will probably be light at best for the next few days.

A couple of anniversaries of interest. It's five years since Ken Deffeyes' famous claim that Peak Oil would be Thanksgiving Day 2005 (I think the degree of precision was somewhat tongue-in-cheek). Whether he was kinda-sorta-qualitatively right, or totally wrong is still unclear.

Also, this blog turned one year old on Tuesday.

Posting will probably be light at best for the next few days.

A couple of anniversaries of interest. It's five years since Ken Deffeyes' famous claim that Peak Oil would be Thanksgiving Day 2005 (I think the degree of precision was somewhat tongue-in-cheek). Whether he was kinda-sorta-qualitatively right, or totally wrong is still unclear.

Also, this blog turned one year old on Tuesday.

Best of Me on The Oil Drum

From mid 2005 to early 2008, I posted at the The Oil Drum, a peak oil analysis site. Recently, Nate Hagens, an editor there, asked me to select my favorite ten of my own pieces there, as part of a big post on the site's historical best posts. Here are my selections:

Labels:

peak oil,

the oil drum

Wednesday, November 24, 2010

Tuesday, November 23, 2010

Monday, November 22, 2010

Thursday, November 18, 2010

New York Times still Parotting CERA

Heavens - the New York Times is an awfully slow learner. There is a piece in there by Clifford Krauss (who has occasionally done better than this), which is a completely one-sided puff piece that reads as though it was written by a PR agency for a major oil company, backed up by the usual quotes from CERA. It's full of stuff like this:

THREE summers ago, the world’s supertankers were racing across the oceans as fast as they could to deliver oil to markets growing increasingly thirsty for energy. Americans were grumbling about paying as much as $4 a gallon for gasoline, as the price of crude oil leapt to $147 a barrel. Natural gas prices were vaulting too, sending home electricity bills soaring.

A book making the rounds at the time, “Twilight in the Desert,” by Matthew R. Simmons, seemed to sum up the conventional wisdom: the age of cheap, plentiful oil and gas was over. “Sooner or later, the worldwide use of oil must peak,” the book concluded, “because oil, like the other two fossil fuels, coal and natural gas, is nonrenewable.”

But no sooner did the demand-and-supply equation shift out of kilter than it swung back into something more palatable and familiar. Just as it seemed that the world was running on fumes, giant oil fields were discovered off the coasts of Brazil and Africa, and Canadian oil sands projects expanded so fast, they now provide North America with more oil than Saudi Arabia. In addition, the United States has increased domestic oil production for the first time in a generation.

Labels:

cera,

new york times,

oil supply,

peak oil

Wednesday, November 17, 2010

Tuesday, November 16, 2010

Monday, November 15, 2010

No Tropical Drought in the Paleocene-Eocene Thermal Maximum

There is a paper that just came out (subscription required) in the current issue of Science that is encouraging with respect to the possibility of widespread drought under global warming. The paper concerns the Paleocene-Eocene Thermal Maximum. This is an episode about 55 million years ago when, for reasons that aren't altogether clear, there was a large release of carbon into the atmosphere. The leading theory is that it might have been caused by volcanic intrusion into carbon rich sediments in the North Atlantic. At any rate, over the course of about 20,000 years, global temperatures rose about 6oC (11oF) from a base already warmer than today. There was a global extinction event, with large amounts of ocean flora disappearing. There was also a large number of new species created, including many new types of mammals.

The episode is of obvious interest as a prototype for what is presently happening with human-caused CO2 emissions, though it clearly isn't a perfect analogy. It happened a long time ago in a world that was quite different in important respects, and the rate of emissions was significantly slower than modern anthropogenic emissions.

In any case, the new paper concerns what happened in the South American tropical forests during the PETM, and comes from analyzing pollen from sediments at three sites in Columbia and Venezuela. The good news is twofold:

The episode is of obvious interest as a prototype for what is presently happening with human-caused CO2 emissions, though it clearly isn't a perfect analogy. It happened a long time ago in a world that was quite different in important respects, and the rate of emissions was significantly slower than modern anthropogenic emissions.

In any case, the new paper concerns what happened in the South American tropical forests during the PETM, and comes from analyzing pollen from sediments at three sites in Columbia and Venezuela. The good news is twofold:

Labels:

climate change,

drought,

PETM

Friday, November 12, 2010

Iraqi Political Maneuverings

Iraq Oil Report has a very interesting piece on the latest struggles to get a new Iraqi government functioning. From the global perspective, I think a key question is what happens to the oil ministry:

So the future direction of global oil production may be hanging in the balance here.

Government spokesman Ali al-Dabbagh said the leadership of the Oil Ministry, Foreign Ministry and Finance Ministry positions would be split among the biggest blocks, while the other two so-called “sovereign ministries” – Defense and Interior – would be led by independent, non-political people.My sense is that Hussain al-Shahristani has done a remarkably good job as oil minister on behalf of his people in getting all the international oil companies involved in developing Iraq's oil, but in striking some very tough bargains with them, rather than giving away the store. While nobody is perfect, my impression from thousands of miles away is that he is an unusually competent and honest public servant by Iraqi standards. I think the odds of a large Iraqi oil production increase will be lower if someone else takes over the position.

Among the sovereign ministries, Oil appears to be the biggest prize, with all three blocks angling for it. The current oil minister, Hussain al-Shahristani, is part of the State of Law coalition.

“Of course we are thinking of the Oil Ministry,” said Kamal Saidi, MP and top ally of Maliki, “But will the political agreement allow this?”

When asked if the Kurdistan Alliance will get the spot, Kurdish President Massoud Barzani said, “It’s not sure yet.”

So the future direction of global oil production may be hanging in the balance here.

Labels:

Hussain Al-Shahristani,

iraq,

oil production

Thursday, November 11, 2010

Wednesday, November 10, 2010

Tuesday, November 9, 2010

Monday, November 8, 2010

Friday, November 5, 2010

Thursday, November 4, 2010

IEA Sceptical of Iraq Oil Increases

According to the Financial Times, which apparently obtained a draft of the next World Energy Outlook:

Past coverage of Iraqi oil issues is here.

Iraq will miss its target of producing 12m barrels of oil a day by 2017 and could take another 20 years to achieve even half that level of output, says the International Energy Agency.Certainly some scepticism as to the schedule and plateau level is in order. Whether this much, I'm not sure - a lot is uncertain. A number of big oil companies are going to lose a lot of money if things go as the IEA predicts. It will be interesting to see the detailed reasoning when the report is published.

In a draft of its annual World Energy Outlook report, the IEA gives a downbeat assessment of Iraq’s ambitions. However, it predicts its crude oil production will overtake that of neighbouring Iran “by soon after 2015”.

Past coverage of Iraqi oil issues is here.

Labels:

iraq,

oil production

Wednesday, November 3, 2010

A Few Election Thoughts

For the most part, I don't find it particularly comfortable or natural to comment on partisan political issues, but I find my thoughts this morning drawn overwhelmingly to the election. So let me share a few of those thoughts.

What I see happening is this: the public is aware, rather inchoately, that things are going badly wrong and that the life they are accustomed to is under threat, but they have no idea what to do. The parties, by and large, have failed to diagnose the roots of the problem, and instead are reflexively proposing to relive their greatest hits of the past. Since the problems of the past are not the problems of the present, these approaches are not working. This is leading both parties into a cycle of over-promising what they can deliver, thus leading to bitter disappointment.

The country faces massive threats to its comfortable lifestyle:

What I see happening is this: the public is aware, rather inchoately, that things are going badly wrong and that the life they are accustomed to is under threat, but they have no idea what to do. The parties, by and large, have failed to diagnose the roots of the problem, and instead are reflexively proposing to relive their greatest hits of the past. Since the problems of the past are not the problems of the present, these approaches are not working. This is leading both parties into a cycle of over-promising what they can deliver, thus leading to bitter disappointment.

The country faces massive threats to its comfortable lifestyle:

- competition with a rapidly rising middle class in China and to a lesser extent with India, now getting the benefits of modern infrastructure but still willing to work for cents on the dollar

- built-in dependence on huge amounts of foreign oil, having depleted most of the domestic supply, thus requiring a huge military to project power all over the globe as needed to maintain the supply, as well as handsome payments to the oil producers.

- The resulting trade deficit, and the implied increasing debt, both federal and private.

- The aftermath of a huge financial crisis

- The beginning rumbles of climate change starting to move from an issue in the distant future to a threat to society in coming decades.

Labels:

debt,

democrats,

elections,

republicans,

united states

Tuesday, November 2, 2010

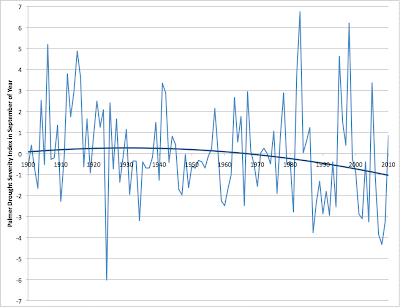

The Hydrological Cycle Now

Labels:

china,

climate change,

drought,

europe,

india,

PDSI,

united states

Monday, November 1, 2010

Thursday, October 28, 2010

Future of Drought Series

This post is for the purpose of maintaining a list of my blog series on the science of drought and global warming.

It's probably fair to have a disclaimer here. These are mostly written to be somewhat accessible for the lay reader. However, it should be borne in mind that I am not a climate scientist, and in particular, I haven't completely figured out what's going on here. There seem to be some notable inconsistencies in the science, and this series is really the process of me trying to get to grips with the situation. So caveat lector, as always...

Anyway, in order that they were posted:

It's probably fair to have a disclaimer here. These are mostly written to be somewhat accessible for the lay reader. However, it should be borne in mind that I am not a climate scientist, and in particular, I haven't completely figured out what's going on here. There seem to be some notable inconsistencies in the science, and this series is really the process of me trying to get to grips with the situation. So caveat lector, as always...

Anyway, in order that they were posted:

Labels:

climate change,

drought,

PDSI

Wednesday, October 27, 2010

Tuesday, October 26, 2010

Monday, October 25, 2010

Sunday, October 24, 2010

Friday, October 22, 2010

Wednesday, October 20, 2010

Rare Earths Again

The New York Times reports:

HONG KONG — China, which has been blocking shipments of crucial minerals to Japan for the last month, has now quietly halted shipments of those materials to the United States and Europe, three industry officials said on Tuesday.

The Chinese action, involving rare earth minerals that are crucial to manufacturing many advanced products, seems certain to further intensify already rising trade and currency tensions with the West. Until recently, China typically sought quick and quiet accommodations on trade issues. But the interruption in rare earth supplies is the latest sign from Beijing that Chinese leaders are willing to use their growing economic muscle.

“The embargo is expanding” beyond Japan, said one of the three rare earth industry officials, all of whom insisted on anonymity for fear of business retaliation by Chinese authorities.

They said Chinese customs officials imposed the broader restrictions on Monday morning, hours after a top Chinese official summoned international news media Sunday night to denounce United States trade actions.

Labels:

china,

rare earths

Monday, October 18, 2010

Friday, October 15, 2010

0.01%

That's the annualized month-over-month change in the CPI-U ex food and energy (for the just released September number over August). The above graph is the month-over-month changes (annualized) since the beginning of 2008.

Labels:

inflation,

united states

Thursday, October 14, 2010

Say What?

The Energy Information Agency of the United States of America can't provide information on the current price of oil?

Wednesday, October 13, 2010

Tuesday, October 12, 2010

3.6 Million Jobs at Risk!

Strange to say, that is not the headline of this piece in the New York Times. Instead it's titled "Google Cars Drive Themselves, in Traffic", and starts out like this:

Anyone driving the twists of Highway 1 between San Francisco and Los Angeles recently may have glimpsed a Toyota Prius with a curious funnel-like cylinder on the roof. Harder to notice was that the person at the wheel was not actually driving.

The car is a project of Google, which has been working in secret but in plain view on vehicles that can drive themselves, using artificial-intelligence software that can sense anything near the car and mimic the decisions made by a human driver.

With someone behind the wheel to take control if something goes awry and a technician in the passenger seat to monitor the navigation system, seven test cars have driven 1,000 miles without human intervention and more than 140,000 miles with only occasional human control. One even drove itself down Lombard Street in San Francisco, one of the steepest and curviest streets in the nation. The only accident, engineers said, was when one Google car was rear-ended while stopped at a traffic light.

Labels:

driving,

singularity,

unemployment,

united states

China Rare Earth Exports Still Stalled

According to Japanese officials (via AP):

Japanese officials said Tuesday they have not seen any easing of China's de facto ban on exports of rare earth minerals — crucial for advanced manufacturing — despite a thaw in tensions over a territorial row between the two Asian powers.I should think so. This incident is a wake-up call to governments everywhere that the current situation of China producing 97% of rare earths is a massive strategic vulnerability. The US and Europe ignore this at their peril.

China has denied that it has halted exports of the materials. But Japanese companies have said shipments of rare earths have virtually stopped since around Sept. 21, held up at Chinese ports by increased paperwork and inspections.

"The reality is, the situation has not at all returned to normal," trade and industry minister Akihiro Ohata told reporters Tuesday. Ohata said he is considering sending senior trade officials to Beijing for talks if the problem persists.

China produces 97 percent of the global supply of rare earths. To cope with growing demand at home, China has been reducing export quotas of rare earths over the past several years, causing concern about the minerals' supply long before September's restrictions to Japan.

Shaken by the potential threat of supply disruptions to its manufacturers, Japan is considering becoming a global center for rare earth recycling and is partnering with Mongolia to develop new rare earth mines.

Labels:

china,

japan,

rare earths

Monday, October 11, 2010

Saturday, October 9, 2010

Personal Note

Yesterday, we entered into a sales contract on a pretty old farmhouse with a barn, a pond, and ten acres or so of mostly pasture. It's a gorgeous piece of land right next to a lovely unspoiled creek that the beavers have turned into a wetland, and with state forest and land-trust land on either side. We weren't really planning to buy until the spring, but I biked past the For Sale sign on my Sunday bike ride a couple of weeks ago, we fell in love with the land, and the FHA is willing to make the thing happen (at least so our bank tells us). Yes we can.

The five year plan is to build our straw-bale super-insulated home next to the existing buildings, retrofit the farmhouse to a higher building performance standard, heat both with geothermal sourced out of the pond, install PVs on the barn roof (or wind if we have enough, but I doubt it), replace our cars with electrics, and get to overall fossil-fuel-free carbon negativity for our extended family.

The long term plan is to have our kids grow up with dogs, goats, mountain bikes and cross country skis, and fishing in the pond, and to help shepherd this particular very beautiful piece of a very beautiful planet through all the changes that are coming. So far, my telecommuting arrangement is working great and I am convinced I can make it work long term. So I propose to stay on this land until I can't ride my bike any more and they wheel me off to the nursing home.

As a weak agnostic, I request those of my readers who are religious to pray that nothing comes unglued during the sales process, just in case it helps!

The five year plan is to build our straw-bale super-insulated home next to the existing buildings, retrofit the farmhouse to a higher building performance standard, heat both with geothermal sourced out of the pond, install PVs on the barn roof (or wind if we have enough, but I doubt it), replace our cars with electrics, and get to overall fossil-fuel-free carbon negativity for our extended family.

The long term plan is to have our kids grow up with dogs, goats, mountain bikes and cross country skis, and fishing in the pond, and to help shepherd this particular very beautiful piece of a very beautiful planet through all the changes that are coming. So far, my telecommuting arrangement is working great and I am convinced I can make it work long term. So I propose to stay on this land until I can't ride my bike any more and they wheel me off to the nursing home.

The short term will involve a few compromises including an existing coal stove, a riding mower for the extensive lawn, longer drives to school, etc. But you have to have a short term to get to the long term.

As a weak agnostic, I request those of my readers who are religious to pray that nothing comes unglued during the sales process, just in case it helps!

Labels:

green building

Friday, October 8, 2010

Thursday, October 7, 2010

Wednesday, October 6, 2010

Tuesday, October 5, 2010

Outstanding!

White House to put solar panels on roof after all. Consider my prior gripes apologetically withdrawn. And, yeah, yeah, I know it's only symbolic, but symbolism matters.

Monday, October 4, 2010

Curious...

This morning, I finished going through the Congressional Budget Office report The Long Term Budget Outlook that I mentioned last week. Readers may recall that my main interest was to know how sensitive the forecasts were to assumptions about future economic growth, and whether the CBO was being more optimistic than I would be on that score.

Well, the interesting, if slightly disturbing, thing is that there is no documentation whatsoever in the document of the CBO's assumptions about the future path of economic growth, or of inflation. There is no chart or table of the assumptions, nor is there any sensitivity analysis. I would have liked to see a couple of cases like "what if the US economy looks like Japan after 1990" and so forth, but there is nothing quantitative about macroeconomic assumptions.

Well, the interesting, if slightly disturbing, thing is that there is no documentation whatsoever in the document of the CBO's assumptions about the future path of economic growth, or of inflation. There is no chart or table of the assumptions, nor is there any sensitivity analysis. I would have liked to see a couple of cases like "what if the US economy looks like Japan after 1990" and so forth, but there is nothing quantitative about macroeconomic assumptions.

Labels:

debt,

united states

Friday, October 1, 2010

Maliki Government Back In?

Sounds like there's hope of an end to the long Iraqi government stalemate:

BAGHDAD — Prime Minister Nuri Kamal al-Maliki of Iraq appeared almost assured of a second term in office on Friday after winning the support of an anti-American Shiite Islamic movement whose return to political power could reshape relations with the United States.

Mr. Maliki’s renomination to the post he has held since 2006, announced in a garden beneath a mosque’s minaret, was a breakthrough after nearly seven months of bare-knuckle, back-room bargaining that have followed the country’s election in March.

Labels:

iraq,

oil supply

Thursday, September 30, 2010

Friedmann on Tea Kettle Movement

NYT columnist Thomas Friedman has a worth-your-time column today:

The Tea Party that has gotten all the attention, the amorphous, self-generated protest against the growth in government and the deficit, is what I’d actually call the “Tea Kettle movement” — because all it’s doing is letting off steam.

That is not to say that the energy behind it is not authentic (it clearly is) or that it won’t be electorally impactful (it clearly might be). But affecting elections and affecting America’s future are two different things. Based on all I’ve heard from this movement, it feels to me like it’s all steam and no engine. It has no plan to restore America to greatness.

The Tea Kettle movement can’t have a positive impact on the country because it has both misdiagnosed America’s main problem and hasn’t even offered a credible solution for the problem it has identified. How can you take a movement seriously that says it wants to cut government spending by billions of dollars but won’t identify the specific defense programs, Social Security, Medicare or other services it’s ready to cut — let alone explain how this will make us more competitive and grow the economy?

Labels:

innovation,

united states

Wednesday, September 29, 2010

Subscribe to:

Posts (Atom)