Yesterday, I posted a graph of the relative size of the US Interstate and Chinese Expressway systems, and pointed out that they are now of roughly equal size. Commenter Joel noted, based on personal experience, that the Chinese system is currently comparatively empty. Statistics on the size of the two vehicle fleets bear this out. The graph above is based on FHWA data (via the Transportation Energy Data Book), and the Chinese NBS Table 16-25, and includes both trucks and passenger vehicles for both countries.

The US fleet is still five times the size of the Chinese fleet. However, over the last decade, the average growth rate of the Chinese fleet has been about 23%/year. The pink line above shows an extrapolation at the same rate, which will result in the Chinese fleet reaching the size of the US fleet sometime later this decade. So those new expressways may not remain empty for too long.

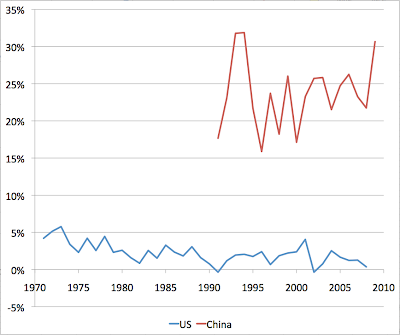

You might argue that growth is bound to slow down in the future. You might be right, too, but there's certainly no sign of that so far. Here's the year-on-year growth rates in the two fleets:

Since the population of China is more than four times larger than that of the US, the number of vehicles per person will still be far lower at the point where the fleets are of equal size. So, if resources were no constraint, we might expect China to continue growing its vehicle fleet far beyond that. Indeed, these statistics should reinforce my critique of the Eichengreen paper arguing that China will slow down by 2015 because it was approaching developed country levels of productivity. With something like 1/7 of the number of vehicles per capita of the US in 2015, that seems unlikely.

However, I think the strains on the global oil delivery system due to China trying to put in place a whole new US sized vehicle fleet in the space of the decade 2010-2020 are likely to be very profound, and I expect it to cause serious disruptions in the global economy.

Fed chairman Bernanke recently said:

Although the recent increase in inflation is a concern, the appropriate diagnosis and policy response depend on whether the rise in inflation is likely to persist. So far at least, there is not much evidence that inflation is becoming broad-based or ingrained in our economy; indeed, increases in the price of a single product--gasoline--account for the bulk of the recent increase in consumer price inflation. Of course, gasoline prices are exceptionally important for both family finances and the broader economy; but the fact that gasoline price increases alone account for so much of the overall increase in inflation suggests that developments in the global market for crude oil and related products, as well as in other commodities markets, are the principal factors behind the recent movements in inflation, rather than factors specific to the U.S. economy. An important implication is that if the prices of energy and other commodities stabilize in ranges near current levels, as futures markets and many forecasters predict, the upward impetus to overall price inflation will wane and the recent increase in inflation will prove transitory. Indeed, the declines in many commodity prices seen over the past few weeks may be an indication that such moderation is occurring.I have no idea how to look at Chinese statistics and be so sanguine about the future of gasoline prices.

11 comments:

There's another option, that I noticed in the Oil Drum's year-end chart extravaganza, and I followed some of the links, summarized here (e-bikes in China).

For modest values of e, an e-bike has a system efficiency competitive with a plausibly fed human cyclist (our food often requires fertilizer, and further processing), so this is at least ok from an energy POV.

What I don't quite get about cars in China, is how the hope to retrofit automobile traffic into their cities. I understand they are building some new cities, so that is part of the answer, but the old cities there, like old cities here, will be with them for some time, and I think they are starting from a baseline of even higher human traffic density. How is this supposed to work? Satellite parking at mass transit terminals around the perimeter? They'll need a mess of them, else it will bottleneck into the parking lots (we get that here, for a mere 2500 car garage).

There's also the issue of whether it makes sense to dump so much money into car-friendly infrastructure, this late in the game. It seems like there's a nice risk of a stranded investment.

dr2chase:

As to "how the hope to retrofit automobile traffic into their cities", the solution to the same problem in OECD cities was to demolish old congested parts of cities in order to put in roads under the rubric of urban renewal or "slum clearances".

As to whether it makes sense: probably not, but that doesn't seem to be slowing them down much. Most of the time, I'm less interested in what people should do than what they probably are going to do.

I do some of my research in China and note that most of the vehicles there are on a very small fraction of the terrain; they are in the big cities. The closer to the action in the big cities, the more and the finer are the vehicles! The highways leading to and from the big cities are increasingly crowded near the city. In remote areas, there are many fewer vehicles, and the vehicles away from the cities are junky, heavily used ag trucks and bulk haulers. This is unlike the US, where road and vehicle quality has little if any relationship to remoteness. We don't see prosperous vacationers in recvees or expensive 4wds away from cities in China. The wealthy and their nice vehicles, including expensive "off road" models, are bound to the cities like bees to a hive.

What is that, 46 million? Sounds a bit low, from estimates I've read elsewhere - for instance this Carnegie Mellon paper cites Argonne Labs at 85 million: Driving Force: Energy and Climate Strategies for China's Motorization - Carnegie Endowment for International Peace. Other docs/news items seemed to suggest ca. 60-70.

New TEDB should be out at the end of this month. BP have new Stat Review out if you haven't heard - 2010 was one of the biggest Leaps Forward (caps intentional h/t Mao) ever for energy consumption.

Stuart

It's worth comparing what is happening in China now to what happened in the U.S. between 1905 and 1930.

IIRC, in that period, we had 25 years of 20 to 25% growth, year after year after year.

Stuart, A couple of thoughts -

Didn't you do a post a while back about the average miles per vehicle being much lower than in the US?

China's CAFE standards are significantly higher than those for the US.

GM is pushing hard to sell the Volt in China. E-bike sales are still around 25M per year, right? I should think HEV/PHEV/EVs will be very important.

Is Chinese consumer disposable income going to grow fast enough to buy all those vehicles? Isn't capital investment more than 50% of Chinese GDP?

OT to this post, and you've probably seen it, but: http://www.bbc.co.uk/news/business-13699952

Even adding 15 million vehicles a year only gets you to 135 million by 2015. One would expect Chinese growth to slow, and peak oil virtually guarantees it.

Interesting. Here's a graph I made comparing car ownership rates over time between the US and China if it's of any interest.

http://s989.photobucket.com/albums/af18/EamonKeane/?action=view¤t=image003-6.png

It's probably not worth spending much time on the details of a China vs US car fleet comparison. China's economy and transport requirements are not like the US's.. they doen't have zillions of pick-ups, exurbs or big-box shopping ghettos. In fact the reverse is more true: the US's economy and transport requirements are not like anyone else's in the world. (Hilarious that Berneke doesn't regard oil as one of the "factors specific to the US economy".. I think this quote is the most interesting part of the whole post)

Stuart's point holds irrespective of the details; that exponential growth in the Chinese car fleet is going to exert pressure on oil supply and thus price and thus the rest of the world's economy. My personal experience of the place is that it is scary how fast they are developing, but the mindset that all development is always good is even more scary.

One clarification here. When I wrote "I have no idea how to look at Chinese statistics and be so sanguine about the future of gasoline prices.", I meant to add ", in the medium term", but somehow forgot. Gasoline prices could certainly go down a bit in the next month or two, but I don't see how they can't spend much of the next decade higher than they are now (absent some kind of major crash in the world economy).

Post a Comment