Friday, February 22, 2013

OECD Oil Consumption

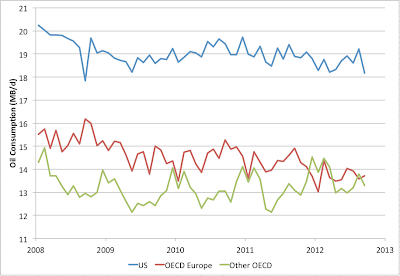

The above shows oil consumption in the major developed regions of the world though September 2012 (according to the EIA). You can see that since the Arab spring (when prices went up), US and European consumption has gone down. In the US this is mainly through improved oil efficiency reducing consumption faster than the rather slow economic growth increases it. In Europe, the double dip recession is probably the main factor reducing consumption. Europe was already more oil efficient than the US, so there is less scope for further improvement.

Global peak oil is probably not here, though I think it likely we are on the bumpy plateau. However, for the US and Europe, peak oil consumption has probably been and gone. We survived. However, certainly the economic situation is not that fun for a lot of people, so perhaps this guy had a point after all (even if he somewhat overstated it):

Labels:

europe,

oecd,

oil consumption,

united states

Subscribe to:

Post Comments (Atom)

10 comments:

Thanks for update - though average numbers are hiding the variability of oil consumption decline within different countries in Europe. And yes, we survived, but we are still at peak, so still (almost) at the top of the oil consumption, so we have a long way to go down, and long way to do down with "bad" debt.

Here are couple of interesting energy links from Rice Farmer

Alex

I think European oil efficiency is overstated - personal consumption is 18 of the US level, but Industrial/Commercial appears to be almost as high, in large part due to diesel not being taxed as heavily for I/C consumers.

I'd love to see a detailed analysis of Euro oil consumption.

Nick:

You can see a slightly out of date comparison of US oil efficiency to some European and other economies here:

http://earlywarn.blogspot.com/2009/11/us-competitiveness-in-tight-oil-era.html

"...for the US and Europe, peak oil consumption has probably been and gone. We survived."

Maybe...

I think the reality is probably more complex.

Personally, I've always thought that one of the flaws in the way "peak oil" was presented was a frequent assumption of a somewhat immediate cause and effect relationship to economic activity - in the same way that it was often presented (simplistically) as following a basic Hubbert dynamic, when clearly reality has proven to be more complex.

I suspect that as a stressor to economic activity, "peak oil" (or maybe better, declining net energy) is very powerful but will nevertheless require time for it's effects to really "sink in".

In the meantime, we can create the illusion of "recovery" - "extend and pretend" or "kick the can down the road" - with ever more debt, money printing, financial shenanigans and reconfigurations of certain aspects of the economy. But how long can this go on before all this bluffing finally gets called?

As an anaolgy, if you've ever known someone with chronic arthritis, you may know that in early stages it's effects can be masked with over-the-counter medication. As the condition becomes more advanced however, even the most powerful experimental drugs can do little to mitigate against loss of mobility and sometimes severe impacts to quality of life.

One thing that seems certain about "peak oil" is that it will be a chronic stressor - time is on its side, not ours.

Gail Tverberg did an analysis not long ago about the decrease consumption in the US, where she found only 7% of the decrease coming from improve efficiency (if I remember well).

Otherwise about the production side, the western "majors" production is decreasing since 2004 :

http://petrole.blog.lemonde.fr/files/2013/02/5-Majors-Total-Oil-Production-fr-MATTHIEU-AUZANNEAU-LE-MONDE-cumul5.png

from :

http://petrole.blog.lemonde.fr/2013/02/21/la-production-totale-des-5-majors-du-petrole-est-en-declin-depuis-2004/#comment-14435

As others have pointed out, life at the peak, or on top of the "bumpy plateau", as Steve Chu termed it, is not life post-peak. We're riding the top of the production curve. We've survived the end of exponential growth so far with accounting fraud, massive shifts of losses to the public sector and trillions in nominal money supply increases, but we have not survived peak oil. That'll will be determined in the not too distant future.

Just extrapolating, we should expect OECD consumption to decline. (That's all consumption, not just oil.)

Population is more or less static, and incomes are decelerating:

GDP per capita growth trend for the top 11 advanced countries, 1961 - 2011.

I'm not sure that the past tense is all that appropriate here. The peak in and of itself just represents a threshold. OK, maybe in this case it's a fat threshold, but if you think about it, the peak ought to represent the very best of times. Life after the peak is something else, and a lot should depend on the shape of the downward curve. Also, "survive" is probably also a bit hyperbolic in the near-term, but I won't take you to task for that, as I detect a certain sardonic intent there.

Wasn't the peak in US consumption in 2005 (and not 2008)?

I'd like to see the same graph going back to 2000 - or even better, 1980.

"We survived. However, certainly the economic situation is not that fun for a lot of people, so perhaps this guy had a point after all (even if he somewhat overstated it)..."

Who's 'We'? Those in the Middle East? North Africa? Anything to do with oil?

Post a Comment