Wednesday, September 7, 2011

European Inflation

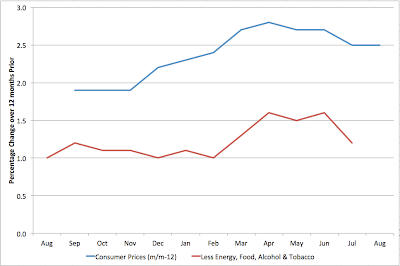

The above graph shows the last 12 or months or so of Eurozone inflation. The blue curve is "headline" inflation - ie including all of a basket of goods and services bought by the average consumer. The red curve excluded energy, food, alcohol, and tobacco - something equivalent to what gets called "core" inflation in the US.

You can see that the rise in energy prices this spring caused a substantial rise in headline inflation and this was starting to bleed through into core inflation - which had otherwise been very low. Now that oil prices have been moderating again, this appears to be subsiding again.

If we look at the last month's data for the core inflation broken down by country, it looks like this:

The PIIGS countries mostly have very low inflation as one might expect (with the partial exception of Portugal). These countries have very weak economies and Greece and Ireland in particular are flirting with deflation. The countries with the highest inflation are the UK and Iceland (neither in the Eurozone) - I assume the mechanism here has been the currency falling after the housing bust and resulting rise in import prices.

Even the big central European economies of Germany and France have quite low rates of core inflation at the moment.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment