So how much we spend on supporting the economy in 2010 and 2011 is almost irrelevant to the fundamental budget picture. Why, then, are Very Serious People demanding immediate fiscal austerity?I am in the camp of people who think it would not be prudent to increase government debt too much higher than it is at present in the US in particular, except in a worse emergency than we currently face. Part of my issue is general prudence - once in a while, serious country-threatening shit happens (wars, financial crisis, etc) and a government should maintain some margin to handle these, and not expend all its powder to promote growth or reduce unemployment. And in particular, I think the U.S. faces some serious long-term issues that are only just beginning to bite, and it's not prudent to max out the credit card ahead of them.

The answer is, to reassure the markets — because the markets supposedly won’t believe in the willingness of governments to engage in long-run fiscal reform unless they inflict pointless pain right now. To repeat: the whole argument rests on the presumption that markets will turn on us unless we demonstrate a willingness to suffer, even though that suffering serves no purpose.

And the basis for this belief that this is what markets demand is … well, actually there’s no sign that markets are demanding any such thing. There’s Greece — but the Greek situation is very different from that of the US or the UK. And at the moment everyone except the overvalued euro-periphery nations is able to borrow at very low interest rates.

So wise policy, as defined by the G20 and like-minded others, consists of destroying economic recovery in order to satisfy hypothetical irrational demands from the markets — demands that economies suffer pointless pain to show their determination, demands that markets aren’t actually making, but which serious people, in their wisdom, believe that the markets will make one of these days.

Awesome.

However, I also think there is something fundamental to the nature of debt that Krugman seems to me to be missing, which explains why the fact that interest rates are currently low is not as reassuring as he thinks, and why it's reasonable to worry about "hypothetical irrational demands from the markets" as he puts it. I would like to make my own mental model more explicit by presenting a simple model of investor behavior under default risk. I'll present it qualitatively, but it should be fairly clear how it could be made at least loosely quantitative.

The basic issue I see is that the collective confidence of investors is a key variable here. If investors are all comfortable that a government can service its debt, they demand low interest rates. In this situation, the cost of servicing the debt is moderate, and the government has no difficulty doing so. However, if investors lose confidence, then they demand high interest rates. This causes the cost of servicing the debt to go up, and makes it harder for the government to do so, and makes default more likely. This can cause a runaway loss of confidence, until interest rates are at predatory levels (high enough that investors hope to recoup their money in the remaining time before default, and/or via a negotiated settlement in a partial default).

Thus it seems to me there is a dual equilibrium situation for countries with significant debt. In the low equilibrium, interest rates are low, and the government can service the debt. In the high interest rate equilibrium, interest rates are high and the government will struggle to service the debt. In either equilibrium, investor perceptions will be correct.

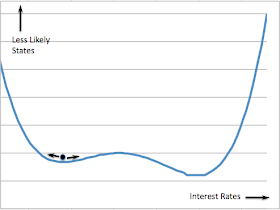

I illustrate this with a diagram that looks like this:

Here the X-axis is interest rates, and the Y-axis is something like the difficulty of the overall economic system being in this state. The little black circle represents the current state of the system, and the little arrows to the left or right represent the range of currently likely fluctuations. You can think of the blue curve as an upside down probability distribution, or you can think of it via a physical analogy as a (gently vibrating) surface on which the little black ball is rolling around.

The hump between the two equilibria arises from the social agreement between investors - if most investors have confidence, then the system is in the low equilibrium, if most have lost confidence then it's in the high equilibrium, and the tendency of investors to herd together causes the in-between states to be less likely.

(Stray technical note to anyone passing with relevant knowledge - yes, this is basically the phi^4 model of statistical mechanics).

If you think of a low debt country, where it's very implausible that the country couldn't pay its debts even at interest rates much higher than at present, the diagram would look like this:

The high-interest-rate equilibrium barely exists, and there is essentially no chance of the system getting into it. Now, if the country runs deficits for a long time, so that the debt level increases, it starts to be somewhat more possible for the high-interest-rate equilibrium to exist. However, because there is a barrier between the two equilibria, and the investors started in the low equilibria, they stay there:

If you just look at market interest rates here, things continue to look ok - interest rates are a little higher, and maybe fluctuate a little more, but the situation as far as observable variables go looks fine. However, if we could really observe the whole blue curve, we could see the situation was increasingly dangerous. As debt increases further, it starts to get really dangerous:

Finally, the low equilibrium becomes sufficiently poorly defined that some random event can cause us to jump out of it and run down-hill into the high-interest-rate equilibrium:

This is the run-on-the-government phenomenon. So the characteristics of this model are that interest rates only respond relatively tepidly to increasing debt up to some threshold, beyond which they abruptly run away to much higher values. There is a highly non-linear response built into the system.

It appears to me that something rather like this just happened to Greece (graph from here):

Greek debt levels were increasing steadily for a long time (decades), but investors rather abruptly lost confidence collectively and started demanding much higher interest rates to loan to Greece (until the EU responded and, at least temporarily, reassured the market).

So I think a lot of the angst in the US and the UK about the debt level comes from an intuitive feeling that perhaps we are in this situation:

We are not in immediate trouble, but some unknown-but-not-too-large additional increment to the debt will push us over the edge.

Now, it's hard to assess what the unobservable parts of the curve really look like, so it's hard to say for sure. But, the point of this kind of model is that merely noting that long-term interest rates are currently low does not provide much reassurance that they won't rise dramatically in future.

Hi, Stuart-

ReplyDeleteI think there are two easy answers why debt levels are much less problematic than you indicate.

1. Japan. Japan has three times the debt level we have and no problems at all, other than lack of enough government spending to end their deflation. This debt forms a huge savings pool for Japanese citizens. Japan has also shown that the ratings agencies don't know what they are talking about (as if we didn't know that already) when they try to forecast the mood of the markets. Debt interest rates remain extremely low despite many downgrades.

2. No default risk. The US government has absolutely no default risk, since it prints the money. As we have discussed, there are other risks- inflation, political-based default, civil war, etc. But there is no financial default risk since the state has endless financial capacity. We don't even have to borrow from the "markets" if we don't want to- we can just spend the money without any borrowing.

Your "general prudence" is, I think, based on an implicit misunderstanding- that we are fiscally constrained as Greece is, or as we have been on a gold-standard system, etc., and that debt is bad. Public debt is not bad per se, and having less of it now would be catastrophic. Here was a good recent quote on the matter, with regard to deficits, which are the real issue:

"By itself, a government deficit is neither good nor bad. What really matters is the consequence: if a budget deficit is too small (spending is too low and/or taxes are too high), then the economy operates below capacity and grows too slowly; if the budget deficit is too large then inflation can result as the government takes too many resources away from private use and prices and wages are bid up. A deficit of the proper size allows the economy to operate at full employment of its resources."

Stuart,

ReplyDeleteWhat you are talking about here is not pricing interest rates based on intrinsic value, but instead based upon speculative pressure. The speculative element always has a very large positive feed back component that will tend to move prices in the direction of the speculative attach. These events are like Ponzi schemes counting on a bailout for even the last-in.

I still see the Volker years as pretty good evidence that the government can put a lid on run away inflation if it wants to. Unlike now when we are up against the zero bound and monetary policy is impotent, during a period of high inflation the Fed can always push them still higher and stifle the money supply.

Here is my interpretation of part of the interest rate question:

http://squashpractice.wordpress.com/2010/05/14/inflation-and-the-risk-free-interest-rate/

I'm more concerned about how we continue to motivate the market in conditions when overall growth approaches zero. Is it possible to have real average positive returns on investment in a zero growth world?

Very interesting argument and dynamic. What is worth discussing would be the time frame.

ReplyDeleteYou are right, Greece is in its own category, borrowing in a 'foreign' currency over which it has no monetary control. The same is true in California, for that matter.

With regard to the US as a whole, the fiscal issue has more to do with the structure of economic investment options to the investor, in this case, the government.

Government borrowing is different from business or individual borrowing; the government creates liabitlities on corresponding bank balance sheets that are then available as assets (to be loaned to others). In general, when there is finance distress there are few investment options for the banks, who turn around and lend the money back to the government as it can pay a higher return with almost no risk.

This circular carry trade is what makes up US government borrowing. As it creates the funds to lend it conveniently creates the borrowing need at the same time.

As the cycle of borrowing is repeated, the balance sheet expansion is counted. As James Galbraith points out, the government - borrowing in its own currency - cannot run out of money any more than a bowling alley can run out of points.

The real hazard is that ever- increasing deficits makes the government look dumb. At some point the government becomes ineffective. The government can recycle funds but cannot create value or new money. Only commerce can do that; new money pulled from the Earth. What medicine the government has to offer is no different from what it has offered from the beginning; debt.

Which is where the risk is lurking, in the general repudiation both of existing debt and of debt itself as a productivity tool. There has been decades of 'stuff buying' and markets are saturated with stuff that has been lived with to the degree that there is nothing more to reveal about having stuff. The novelty of stuff is passe and the urgency to gain more credit to gain more stuff is fading.

This is coupled with the increasing repudiation of existing credit and obligations. This puts the dangerous tail risks on the busines/consumer end of the credit structure.

As it has been from the beginning, the systemic risks have originated at the bottom of the economy and risen. Oil price rises, business failures, declining quantity and quality of employment, outsourcing, declining real wages, excess household credit exposure, subprime borrowing, the unwinding of the 'wealth effect' from collapsig asset price bubble(s), securitization breakdowns, etc have all started at the bottom of the economic food chain. Right now, the people in the countries are going broke faster than governments.

Yes I think it weighs on people's minds when they realize there is this confidence event horizon beyond which a nation's finances severely deteriorate and after which monetary and economic collapse are inevitable (without help). There is a point beyond which there is no equilibrium.

ReplyDeleteBy collapse, I mean devaluation & depression.

For the US there may be 2 equilibrium points and then a ski slope down. Well, I hope the 2nd one exists. But, it may not. If anti-tax sentiment is high enough, and deficits are large can it tolerate a real interest rate of even 6%?

But the US graph ends with a down slope too. I think. Not a slope up. i.e. at that debt level, exploding interest rates are a dead certainty.

What Krugman hints at, but rarely says, is that the only source of further stimulus money is the printing press. Certainly America, Japan and the UK will never default since they all borrow their own currency. Why do money managers love the US dollar? Because their performance (made or lost money) is defined in US dollars. So they can never lose money if they hold US dollars or equivalent.

ReplyDeleteGovernments would love to have a little inflation: enough to keep the velocity of money at a normal rate. But they don't currently have the right levers. During decline (which we've got now and is expected as oil production declines) you need a lot of inflation to keep money moving, but current policies will cause deflation.

Burk's point 2 has part of the story.

ReplyDeleteThe problem with your model is that it considers one asset in isolation. The choice for investors is always a relative one, from a set of possible investments which can be ordered from low risk and low return on one end, to high risk and high return on the other. They *can't* withdraw their money from the market and hide it under the bed--there's too much of it. They *have* to give it to some-one else, i.e., make an investment. What do they do?

Investment choices are made as investors balance the opposing emotions of greed and fear. Let's assume "investors lose confidence"--in economist jargon, there is a "flight to safety": fear overwhelms greed for most investors. What do they do? Look for a safer place to put their money.

While US treasuries are the lowest-risk investment in the world, wholly risk-averse investors will buy them in preference to any other investment. This is why the US dollar rose against other currencies, seemingly perversely, as the sub-prime debacle unfolded. The crisis was happening in the US; one would have thought that investors would sell the US and buy other countries. That didn't happen, because the choice facing investors is a relative one: *everything* had suddenly got a bit riskier, but US treasuries were still the lowest risk option.

The scenarios you describe can take place only if US treasuries lose their place on the left-hand end of the risk scale. Krugman doesn't see that happening in in the foreseeable future. He makes the point over and over that the US is not Greece, it's not the UK, it's not Japan, or even Germany. The US treasury is where wholly risk-averse money has to go. There's nowhere else safer. Krugman's peeve is that the "serious people", as he calls them, are acting as if this is not the case. He doesn't see any possibility of US treasuries losing their lowest-risk status for decades at least, and no evidence has been offered for it. Nor is there any evidence of incipient rises in treasury interest rates.

Krugman is not saying the deficit is not a problem, just that it's not *today's* problem. The time when your labour utilisation is at most 90%, and by some measures 83%, is not the time to stop feeding money into the private sector, by cutting the deficit in the public sector. His is Saint Augustine's prayer: make us good, Lord--but not yet. Wait till our tax receipts are higher (because more people are working) and the job is easier.

-----------

Another thought has just occurred to me. Maybe the "serious people" feel that the world economy as a whole has jumped into a new state where the current levels of unemployment are as low as they will ever be. Perhaps they've been reading your blog and decided the approach of the singularity will only decrease employment from here on. If this is as good as it gets, then perhaps starting to reduce the deficit right now is a good idea. But once again, there's no evidence, yet.

I love your work, Stuart, but as soon as you say Krugman is "the nature of debt that Krugman seems to me to be missing" you immediately lose 95% of your credibility. It can be said with a high degree of certainty that his understanding of the nature of debt is several orders of magnitude greater than your own.

ReplyDeleteGoing after Krugman is the blogger's dalliance-du-jour, so hop right in to the Krugman-bashing swimming pool.

But to claim you understand debt better than he makes you seem silly and leads a reasonable reader to assume that whatever else you say in the post has a high probability of being silly too.

Paul:

ReplyDeleteYou raise a fair point. I too use position in the academic pecking hierarchy as a rough first heuristic to decide who to listen too, and if you don't want to go deeper into the subject than that, you can certainly stick to that approach. If I lose you as a reader, I certainly regret it, but that's your privilege. I would hope instead that you would dig deeper into the controversy and make Krugman's case here in detail.

I also am conscious of the dangers of blogging about things where I am not a specialist, or at least don't have a few years thinking about something under my belt. For example, when talking about climate change, I rarely step far out of the bounds of just reporting what current scientific papers say, because while I've gotten to the point where I have read quite a bit of the recent literature on and off, I don't think I've done enough low-level technical work myself to be at the point where I can comfortably second-guess a peer-reviewed paper .

However, I find economics to be in a somewhat different category. First of all, as a profession, economists have collectively made a number of gross errors in my lifetime (for example, the existence of both the tech bubble and the housing bubble were denied by the bulk of mainstream economists, though they seemed perfectly clear to me just using common sense and a general understanding of life and people). As someone with a physics training, I can see that economists constantly make arguments that just flat out don't make sense about energy and reveal a basic misunderstanding of the nature of society as a dissipative thermodynamic system. Whereas sciences such as chemistry, biology, ecology have long recognized they were built on a foundation of physics, somehow, this does not seem to have fully penetrated economics (some practitioners are better than others, of course).

As a simple matter of prudent management of my own and my family's affairs, I have to develop an opinion on economic trends, and in particular on many of the dangers that I write about in this blog. And in the course of doing this, I've come to see that economists make these frequent errors. So why is this?

Firstly, I think there are deep theoretical reasons why the knowledge of economics is inherently limited having to do with the fact that financial markets will attempt to put to work any useful economic knowledge for profit, and this will change the system as it is under study in ways that tend to falsify the truth. I expounded on this in Why the Federal Reserve will not stop Bubbles.

[interrupted by silly 4k comment limit]

[continuing prior comment]

ReplyDeleteBut also, it's my diagnosis that most of the field has too strong an ideological commitment to mathematical models based on rational self-interested actors acting individually. People are certainly capable of both rationality and self-interested behavior, but it's very far from a complete description of their behavior, and I think when taken to far can lead to elaborate theoretical structures with rotten foundations.

Now, Krugman (who I've been reading regularly for many years - columns, blogs, books, and increasingly papers - and have learnt a great deal from) is better than most economists. Certainly, no-one can accuse him of missing the housing bubble. But still, over time I've come to feel that he isn't infallible either, and in particular his recent positions on the debt I don't altogether agree with. I think he's coming from a paradigm of thinking this is just another financial crisis, to be dealt with as other financial crises by a sufficiently large dollop of Keynesian stimulus. It's certainly true that there are elements of this financial crisis that are like others, but the US is also facing a number of massive challenges in the medium term - transitioning away from oil, dealing with the rise of China as a larger industrial power than the US, retirement of the baby boom, as well as the increasing sidelining of a larger and larger portion of it's population by automation/globalization. All these things will call for spending and, since Americans aren't currently very willing to pay taxes, will tend to raise the debt. So I'm concerned about calls for very large additional increases in debt now to keep the consumer spending going. The US needs to be doing less consumer spending and undertaking a deeper transformation in how it operates.

Finally, I note that it's not like Krugman is representing a monolithic opinion of all relevant experts. In the blog posts I cited above, he's basically saying that guys with the stature of Jeffrey Sachs are idiots. Krugman doesn't, in those posts, make any argument stronger than "markets aren't demanding high interest rates now, so the debt level must not be a problem". How is this argument different than saying in 1999, "the market is saying pets.com is worth $X00/share, so it must really be worth that". The crowd is frequently wrong, as well as often right, and the path of wisdom involves trying to discern which case is which.

Greg:

ReplyDeleteYour point about relative preferences is right, and I agree with your interpretation of the lowering of treasury rates during the financial crisis. That may indeed still be keeping treasuries down. Obviously, there are good historical reasons for this: the US has very little in the way of default over an extremely long period (if we discount some inflation here and there), and was the world's dominant industrial and military power, with deep transparent financial markets, strong institutions and relatively little corruption. It also had a strong economy that, prior to the 1970s, was based primarily on domestic resources.

Still, clearly there must be some level of debt that the US could not service without inflating (I assume even Burk would agree). If debt was 20X GDP, investors would have lost confidence, regardless of the status of other assets. So it cannot be the case that we are invulnerable to such things - the lack of desirable alternatives just shifts the demand curve for US assets by a finite amount.

In terms of what the alternative assets might be in the event of a loss in confidence in US debt, one possibility is Chinese institutions improve and Chinese assets become desirable. I think that's not too likely in the next decade, but perhaps cannot be ruled out over longer time horizons.

Another possibility is that we would see a big inflation in tangible assets (land, commodities, gold, etc) as people lose confidence in the government backing of the financial system and tried to turn financial assets into tangible ones ahead of a government default.

(I'm not saying this scenario is imminent. I'm saying we've got a hell of a lot to get through in the next few decades and we should keep some of our powder dry).

Could be I just haven't looked hard enough but I can't find any place where Krugman comments on the price of gold. Which continues to hit (nominal) records.

ReplyDeleteThus I read low yields on treasuries as a desperation trade rather than a vote of confidence....where else can you go (other than gold)? Yes, treasuries are very popular right now but it's a bit like the bow of the ship being popular when the stern is underwater. You have to be even more desperate to buy gold because there is no yield and it's volatile. As far as I can figure out somebody holding gold is actually terrified.

From the point of view of preserving value, significant inflation is default, thus in our lifetime the US has defaulted. The dollar was devalued by half. (1975- 1982) But the US rebuilt monetary credibility in the 80s & 90s and hasn't squandered it yet. What if that perception changes (as the price of gold indicates it might)?

See today's New York Times: Uncertainty Restores Glitter to an Old Refuge, Gold.

Contra Greg there are other options for money other than Uncle Sam's paper.

Note that if I expect to lose most of my purchasing power in the next few years, I could be more willing to consider aggressive hedge funds that beat up on small nations and other destabelizing schemes. Wouldn't folks have nothing to lose by backing a hard money administration with whatever cynical methods they can fund? Capital is much more powerful than it was in the '70s. Now it's less difficult to weaponize it.

I believe the countervailing process to reduce public debt is a desire for productive investment and lack of desire for saving. Government bonds may be safe, but they are low-yielding. With US GDP at 14T, public debt at 10T, and private debt at ~28T, public debt probably can't go much higher than 3X GDP, just from arithmetic of people's possible investment/savings resources. So let's suppose all debt/investment is in bonds- then virtually no other investment is taking place. At some point, people will need to consume from these savings, and will wish to invest in actual productive capacity with higher risk and reward.

ReplyDeleteAt that point, the government may find no takers for its debt, at least at the low real interest it is willing to pay as part of its monetary policy, which is what this debt was about in the first place. This is the position of Japan, which is pretty much at this maximum position, with its savers demographically ready to start spending more than saving, and the government interested in getting the private markets to invest more in productive enterprises.

Then such a government has to decide whether to spend anyhow, which is entirely within its power, or not. This decision would be based on inflation policy- if we are in deflation with high unemployment (as now), then more spending (and direct hiring) would be indicated. If not, then not. In the end, I certainly agree that the government does need to be able to reduce its spending to remain in parallel with macroeconomic needs, roughly set as the amount of the economic pie it takes by taxation as per the democratic process, plus leakages to savings and trade deficits. But variations around this setting can and should be carried out in light of the gross instability / cyclicity of private markets.

The powder we should be keeping dry is the educational level and productive capacity of our citizens, and the ecological sustainability of our activities. Those the real looming deficits.

I am having trouble with the graphs. You state that the "Y-axis is something like the difficulty of the overall economic system being in this state." Then you treat the graph as having gravity downward on the Y-axis with the little ball trying find low points. Why must the economy drift into low difficulty states?

ReplyDeleteI know you don't believe that, because by the end you show runaway interest rates. What makes that the lowest difficulty state? That's more like a Prisoner's Dilemma worse outcome amongst the game players.

I'm not trying to argue against you're thoughts on debts, just the presentation. Personally I feel that debt based economics ignores the physical world and is ultimately unsustainable, so I agree, but I'm not convinced of any problems based on what is presented here.

US has two big problems, one of these problems are shared with the rest of the western world, whereas one is unique for the U.S.

ReplyDeleteIt is clear that many emerging economies have large comparable as well absolute advantages in terms of trade relative to the western world. This has had widespread negative impact on the western economies in the last 20 years and will have an even bigger impact in the future as trade develops further and more into services. The emerging world has become strong and independent, and moves further with impressive thrust as it imports technology.

In order to fill the gap and to maintain the standard of living the households were permitted by the financial system to take on more and more debt. This worked for a long time as an adrenaline shot affecting private consumption positively and counteracting the ongoing demise of the US real economy. When this became unsustainable the government has assumed the role of assuming debt, trying to kick the can further on for a bit longer.

The inevitable truth is that US for a long time has been living beyond its means. The US population has a need to lover standard of living with 20-30% in order to restore equilibrium.

Krugman likes to compare todays problem with the second world war. If we could grow ourselves out of debt then, we could to it again. The problem is that the current ongoing catch up effect from emerging economies and unfavourable terms of trade for the US makes this comparison invalid.

Back then there was very strong productivity improvements based on technological innovation and US had competible terms of trade. The poor world provided output reminiscent of slave labor to the western world.

I would like for Krugman to answer two important question. What are the US going to sell and who is going to buy it? There will be no growing ourselves out of the problems this time around. Rather the pain will be minimized by facing austerity now and reconcile ourselves with the fact that standard of living will never be the same.

In fact, the current unemployment of close to 10% may understate the trend that the US is headed at, since employment is boosted by reckless spending and artificially low taxes that are not sustainable.

The only trustworthy and likely solution to long term higher employment may be to radically lower wages, so as to produce output at more favourable terms. If an able person is willing to work for 4$ an hour, he will probably have no hard time finding a job.

The second problem, which is possible to deal with, is the soaring costs of the US healthcare system. I’m usually pro free market but this is a clear example where the free market failed.

Obama probably has a long term vision of nationalized US health care European style, but in order to achieve this politically, it will have to be made in many steps during a long time period. Probably impossible to drive the costs down sufficiently.

Compared to European countries with well functioning healthcare that covers all citizens, the costs of US healthcare is approximately 1000 billion $ higher each year. This does not adjust for the fact that app 40 million Americans are uninsured.

The unbearable and soaring health care costs are a drag on US, its corporations and people that will for sure make the US go bust if not dealt with. This is what makes US, in my mind, worse of than Europe.

The proper and possibly only way of dealing with it is to nationalize all health care, doctors will be paid at a scheme starting at 50 T$ per year for a junior doctor up to app 150T$ for a senior chief physician. Prescription of drugs should follow restriction and rules, so as not to administer expensive medicare if not warranted. It would probably be a good idea to ban all private health care for a certain time period so as to foster swift reform. It would also probably be a good idea that the state covered education costs for medical students.

This is probably what the IMF is going to do if / when the US defaults.

About the topic of printing money, this is indisputably something that the US possibly could embark on. However, this is in my mind, highly overstated. Numerous studies as well as history show that austerity perhaps combined with a default produces the best long term results and is preferable to using the printing press. With result I refer to long term economic output from the economy.

ReplyDeleteIf the US were to print substantially, runaway inflation would cause long interest rates to shoot through the roof along with a demise of the dollar. Bond investors would possibly loose more than after a default, depending on the time to maturity of the bond. The loss of confidence would be no less than after a default, rather more severe, and would take decades to rebuild. In terms of the market, heavy using the printing press is viewed as a default like situation.

If in distress I strongly believe that the US would be wise enough to opt for defaulting on its debt. If the US were to use the printing press in a big way the US in the longer term would turn into a very poor country indeed. There is no free lunch, i.e there is no way that the US can live beyond its means in the long term.

Martin's argument seems to ignore the fact that the US dollar floats freely on the international currency exchanges. Our standard of living vs other countries will adjust naturally through this mechanism as the relative productivity of the US vs other countries changes. Which is to say that wages in India are rising in fields where they compete with the US. Overall, however, the rupee/dollar exhange rate has not changed much over the last five years, but it will as the productivity of India as a whole increases, if it does.

ReplyDeleteThis process does not require government austerity or some conscious plan to lower our standard of living. Our standard of living will keep on rising as our own productivity goes up- no need to pauper-ate US labor to compete with China and India. We will just be less able to import extra value from abroad. We certainly do not depend on exports for our overall economic growth. Growth over the last several decades has happened in the face of continuous trade deficits, due to the willingness of other countries to accumulate our currency.

While long-term medical obligations are an issue, (as is the trillion dollars we spend on defence, which other countries don't), we certainly aren't facing default over this or any other fiscal issue. In the current deflationary and unsettled climate, bonds are flying off the shelves at practically zero interest, many gobbled up by the very countries (China) who otherwise would be enjoying improved terms of trade vs the US by spending their dollars. Why is that? It is because they value the stability/development of low-wage jobs over the increased living standard they could enjoy with higher yuan/dollar exchange rates.

Please do not worry about US default. We have no need to do so whatsoever. US debt represents the savings of your fellow citizens, who would be mighty upset if those obligations were erased needlessly.