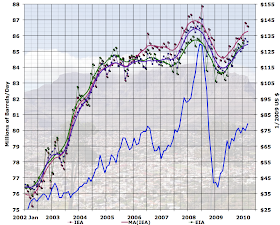

A number of us interpreted the 2005-2007 plateau in liquid fuel production as the onset of peak oil, or at least the onset of a "bumpy plateau" in oil production. Staring at the incoming data each month, it now appears to me that that view was probably wrong: even if you discount Iraq (and who knows what will happen there), it's still the case that global oil production (or at least total liquids) can likely go above the 2008 peak, and given that, it now appears that there is going to be at least a gentle upward slope to global oil production in the post 2004 period taken as a whole:

It seems particularly significant that most of the post-great-recession production recovery is coming from non-OPEC production.

But, on the other hand, the sunny mainstream view also proved to be wrong. For example, if you go back to the US EIA's 2005 International Energy Outlook, you find that they completely failed to anticipate the plateau and consequent price spike:

Oil prices were about to double, and are today, in the aftermath of a huge recession, off the top of that chart; they didn't see it coming at all.

So what do those events mean?

It seems the most viable interpretation is something along the lines of what Chevron CEO David O'Reilly said in 2005, the era of easy oil is over:

As populations grow and economies take off, millions in the developing world are enjoying the benefits of a lifestyle that requires increasing amounts of energy. In fact, some say that in 20 years the world will consume 40% more oil than it does today. At the same time, many of the world's oil and gas fields are maturing. And new energy discoveries are mainly occurring in places where resources are difficult to extract, physically, economically and even politically. When growing demand meets tighter supplies, the result is more competition for the same resources.In particular, the rest of the world used to be able to meet growth in global oil demand while maintaining a large cushion of spare capacity in OPEC - this is no longer true, the OPEC spare capacity cushion is small (and was very small in 2005-2007), and it doesn't seem likely that it will ever get very large again.

So, if not peak oil, this is obviously an important precursor to peak oil - we are in an era in which global oil production can be increased, but it's more difficult to do so; it requires more effort and investment.

It's very difficult at this point to say how far we are from peak oil in years - the uncertainty due to Iraq alone is enormous. However, we perhaps can quantify "more difficult" somewhat. In this next graph, I estimate the fraction of global GDP - perhaps we should call it GCP for "global civilizational product" - expended on oil. In particular, I took GDP from the IMF (latest World Economic Output) estimated at purchasing power parity - which is about $70 trillion at the moment. Then I estimated the amount spent on oil by taking the average price of imports to the US, and multiplying that by global oil production (from the EIA's table 4.4). Obviously, this is slightly rough, but it's probably accurate to 10% or 15%, and the error is likely to be reasonably stable over time. And to the best of my knowledge, nobody produces a detailed breakdown of global GDP by industry, so it's not easy to be much more accurate than this.

Anyway, the resulting data (only since 1980 unfortunately) looks like this:

As you can see, after the 1970s (which was clearly a transitional event associated with the peak of US oil production and the passing of pricing power to OPEC), it generally took ballpark 1-2% of global GDP to generate enough growth in oil production to overcome decline in existing fields and power ongoing civilizational growth. At the moment - 2009-2010, and probably at least for another year or so, it's taking about 2-3% of global GDP to overcome declines and produce a somewhat slower rate of global growth. The higher percentages in 2007-2008 we can probably discount somewhat as an initial market overreaction to the unanticipated surprise.

2-3% is not that much. Probably there is room for this ratio to go a lot higher before it would cause the global economy to grind to a halt altogether.

Stuart,

ReplyDeleteI've done a similar analysis of GDP and energy costs that's consistent with yours. Differences are that mine went back to 1950, was confined to the U.S., went up to 2008 only, and included the cost of natural gas and coal. See my 12/13/09 post on my blog, http://michaelaucott.blogspot.com.

For 2009, the percent of U.S. GDP spent on fuels is likely back down into the 4% range, reflecting not only somewhat lower oil prices, but the large decline in natural gas prices, which is related to the recent increase in U.S. production from shales. This percentage is still higher than the historic rate, but indeed seems more comfortable. The future trend in natural gas price could be an important factor.

I continue to feel that production of crude might be more relevant than total liquids, especially considering Stephen O'Brien's point (in his comment to your previous entry) that NGLs may not be easily convertible to liquid transportation fuels. Total liquids also includes biofuels, which clouds the picture.

Very nice analysis, Stuart. I think the concept of viewing oil prices as a percentage of GDP, both at the global and national levels, gets directly to the heart of what peak oil is all about. It is oil's unique qualities that have allowed industrial society to exist. As production declines, our thirst for oil will not abate one whit. I am convinced that we will spend ever increasing percentages of our world, national and individual incomes chasing the last drops of that magical liquid.

ReplyDeleteI am, however, less sanguine about the world's ability to produce more even with increased efforts. What we have seen in the past year is, I believe, one of the last (if not THE last) sputters in production as the world prepares for its descent. And the fact that that growth is entirely due to NGLs only reinforces my conviction.

There are some who suggest that oil will never rise above a certain percentage of GDP because anytime it goes above that magic number, the economy will contract and demand destruction will ensue. I believe that argument, based as it is on analysis of previous recessions, discounts the fact the a peak oil future will not be like the past. Oil, like water, is a commodity of such unimaginable value that it will command almost any price required if the supply of it is sufficiently limited. Demand destruction will occur, but each time it will be followed by even higher prices.

Mike:

ReplyDeleteYeah, I was going to try and look at NG and Coal at the global level tomorrow.

I understand that "gross world product", GWP, is the usual term for what you call "global GDP."

ReplyDeleteOne interesting variation of this analysis would be to focus on industrial output rather than total GWP, since services and final consumption are in a sense derivatives of industrial production.

The essence of the argument in the "Limits to Growth" reference scenario is that eventually so much industrial output is used to maintain industrial production that the absolute amount left over (for making service capital goods and final consumption goods) starts to decline.

(For example, having to make more and more drilling rigs and well pipe to maintain the same level of O & G production means an increasing proportion of steel production is used for that, instead of for rebar and cars. If steel production cannot be expanded quickly enough, the absolute amount of steel available for rebar and cars starts to decrease. The physical depreciation of industrial plant and the declining quality of remaining resources are the ultimate causes of the problem, in LtG.)

Since, apparently, a variable and increasing part of GWP consists of services and final consumption, it would be good to correct for that and see whether there's a difference. Easier said than done, of course.

Re Stephen's paragraph 3, this is the usual pattern of economic substitution for an increasingly expensive product. For some uses, there are relatively cheap alternatives and for others the alternatives are more expensive. A scarcity signal (rising price) causes demand destruction in the short term, followed by a move to alternatives in the longer term. No problem from a systemic risk POV, unless we have got ourselves into a situation where we can't afford to invest in alternatives, or we don't have enough time before production crashes completely -- neither of which is the case.

I think there was an article on The Oil Drum, in the last year or two, that showed an expenditure of 5% of GDP on petroleum products is likely to lead to recession.

ReplyDeleteIsn't the cost of energy overall, a player here? If oil is 38% of energy, then oil at 2% of GDP might translate into energy, overall, being 5% of GDP. Is that worrying?