With the emphasis on the could.

I have been associated with the view that the stagnation of oil supply growth from late 2004 on was likely to be the onset of a "bumpy plateau" of oil production - that oil production would not go too much higher, although it wouldn't decline quickly either. You can see articulation of this point of view, for example, at old Oil Drum pieces like Why Peak Oil is Probably About Now, and Hubbert Theory says Peak is Probably Slow Squeeze.

Generally, events of the past few years have been reasonably kind to this point of view. The major producers (eg Russia and Saudi Arabia) seemed to have more-or-less reached production plateaus. Overall global production bumped up a little in late 2007 and early 2008 in response to the very high prices, but not much. Similarly it fell in 2009 in response to the great recession, but not much. Bumps on the bumpy plateau, it has seemed to me (and this would be even more true if you looked at the data ex-biofuels). Now production is going up again. Here's what the latest data for global liquid fuel production looks like (with the monthly price on the right axis):

However, I think it's important to note that a potential game-changer has developed recently that could render that point of view obsolete (which is a kinder, gentler way of saying "wrong" :-). A couple of years ago, Iraqi oil production was declining and it didn't seem too likely the country would stabilize any time soon to allow that to change. However, the post-surge stabilization of Iraq has now allowed Iraqi oil production to start creeping up, and in 2009 the Iraqi oil ministry has announced large numbers of contracts with major oil companies to bring production up from the current 2.5mbd or so to 12 mbd over the course of the next 6-7 years. It is also announcing a series of projects to increase the physical export capacity of the country in line with these oil production projects.

It seems to me that the possibility that Iraq may actually succeed in doing this should be taken seriously. If it did succeed, that would act to delay the final plateau of oil production by a decade (ballpark), make that plateau be at a higher level (95-100mbd ballpark), and significantly moderate oil prices in the meantime, with even some possibility of causing a serious breakdown of OPEC discipline and a period of significantly lower prices akin to the 1980s-1990s lull (though probably not as long or as deep a lull as that). If that were to occur, it would likely have profound consequences for alternative energy projects, biofuel companies, and automobile fuel efficiency. A period of lower oil prices will put adaptation projects on hold for the duration.

At the same time, even in this scenario, there's a real chance of another oil price shock before the main rise in Iraqi oil production arrives.

At this stage, it seems too soon to say the Iraqis definitely will succeed. But the scenario that they might seems worth serious consideration. In this post, I'd like to take a first look at the situation, including:

- Status of Iraqi oil reserves

- History of Iraqi oil production

- Shape of the announced oil production plans

- Character of the architect of the Iraqi plans, oil minister Hussain al-Shahristani

- Indications of the improving stability of Iraq.

- Implications and conclusions.

Iraqi Oil Reserves

There doesn't seem to be too much dispute that Iraq has enough reserves to support far higher production than has actually occurred in the past. Jean Laharrere (well known oil industry veteran and coauthor with Colin Campbell of the 1998 SciAm peak oil article) recently summarized the situation as follows:The "technical 2P" numbers here are from proprietary Petroconsultants (now IHS) data and claim to represent the best estimates of the petroleum engineers of how much oil is likely to be recovered (ie with 50% probability, as opposed to the 90% probability required for proven reserves). "Gb" = billions of barrels of recoverable oil.

There is a great deal of controversy about the potential of Iraq's western desert, which is largely unexplored. IHS has claimed that there might be as much as 100Gb there in addition to the known reserves, but since none of this has been confirmed with drilling, it remains speculative (and Laharrere for example doesn't accept this estimate). Big Gav had an Oil Drum post Iraq's Oil: The Greatest Prize Of All? some time back with more background.

However for my purposes today it's enough to note that even if there is only 90Gb, with an initial 5% depletion rate (in line with industry practice) that could support a rate of 12 million barrels/day (the depletion rate is what fraction of the known reserves are produced in a year). So the announced Iraqi plans would not seem to be precluded by lack of reserves. As we will see below, the field by field reserve estimates and production plans that have been made public also seem generally consistent with the plan.

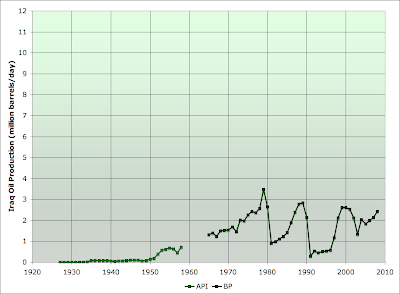

Historical Iraqi Oil Production

This next graph shows annual average Iraqi oil production over the long term - since the beginning (with a gap for 1956-1964 which falls between my two data sources). I deliberately made the y-axis scale run from zero to 12 mbd to emphasize that Iraq has never produced anywhere close to its potential.Production was increasing rapidly and roughly exponentially until 1979 when Saddam Hussein took power. Since then, it's been one war or crisis after another, and production has never even reached the 1979 level again, let alone continued up close to the now proposed 12mbd.

A more detailed graph shows the monthly production over the last decade according to various data sources:

We can think of this in several eras. Prior to early 2003, Iraq's oil production was under the control of the United Nations Oil-for-Food Program which apparently resulted in highly variable production. Then in the spring of 2003, the US invasion resulted in an almost complete cessation of oil production for a short period. Following the US invasion, there was a partial recovery in oil production, but this gradually decayed amidst worsening violence, reaching a low of about 1.5mbd in February 2006. Following this, and especially after the 2007 troop surge and associated developments the country has been getting more stable and oil production has been steadily increasing.

If we simply extrapolated the existing rate of improvement forward, we'd get something like the following:

We'd cross 3 million barrels/day by the end of 2012, perhaps reaching close to 3.5mbd (versus about 2.5mbd today). This would not be very game-changing.

However, Iraq has now announced plans that are much more ambitious than that.

Iraqi Oil Production Plans

Iraq held two rounds of auctions for oilfield management contracts in 2009 that the large international oil companies have responded to. The first round, in June, were for fields that were already in production and set up contracts in which companies get paid a fee per barrel for all production over the existing level. The second round, last month, were for fields not yet on stream. The Iraqis seem to have driven hard bargains - the oil companies are being paid a flat fee per barrel that is generally under $2/barrel in the safer parts of the country, and thus will not benefit from high oil prices - all price risk/reward remains with the Iraqis. Nonetheless they were able to attract some bids from large competent oil companies with a track record - the likes of Shell, Exxon, Statoil, and Lukoil, and have been signing preliminary contracts with them. According to the oil ministry, the total contracts awarded amount to 12mbd of production, and this could be achieved within six years. The BBC reports:Iraq's oil capacity could reach 12 million barrels per day (bpd) in six years, the country's oil minister says.From various news reports and other sources, I have put together the following table of the fields and contracts that have been announced. So far, I have been able to account for 11.2mbd out of the 12mbd, and 65gb of reserves, on a field by field basis with actually announced contracts/awards.

Hussein al-Shahristani told reporters in Baghdad that oil producers would not necessarily operate at full capacity, but would take into account demand.

| Field(s) | Plateau (mbd) | Co. | Resv (gb) | Depletion | Fee ($/b) | Links |

|---|---|---|---|---|---|---|

| Rumaila | 2.85 | BP, CNPC | 17 | 6.1% | $2.00 | 1 |

| West Qurna Ph I | 2.33 | Exxon, Shell | 8.7 | 9.8% | $1.90 | 1, 2 |

| West Qurna Ph II | 1.8 | Lukoil, Statoil | 13 | 5.1% | $1.15 | 1 |

| Majnoon | 1.8 | Shell, Petronas | 12.6 | 5.2% | $1.39 | 1, 2, 3 |

| Halfaya | 0.535 | CNPC, Total, Petronas | 4.1 | 4.8% | $1.40 | 1, 2, 3 |

| Zubair | 1.125 | ENI, Kogas, Occidental | 6.6 | 6.2% | $2.00 | 1, 2 |

| Gharaf | 0.23 | Petronas, Japex | 0.86 | 9.8% | $1.49 | 1, 2 |

| Badra | 0.17 | Gazprom, Petronas, Kogas | 0.8 | 7.8% | $5.50 | 1, 2, 3 |

| Al-Ahdab | 0.115 | CNPC | N/A | N/A | $3 | 1 |

| Qaiyarah | 0.12 | Sonangol | 0.8 | 5.5% | $5.00 | 1, 2 |

| Najmah | 0.11 | Sonangol | 0.9 | 4.5% | $6.00 | 1, 2 |

| Total | 11.185 | 65.36 |

Given that there are still ongoing talks about Kirkuk, Nassariya, and other smaller fields, the 12mbd number seems like not much of a stretch for the sum of the contracts by the time all talks are finalized. Some of the depletion rates appear fairly high, but not outside known industry practice (it's not hard to find projects in the Megaprojects Wiki that have 10%-15% initial depletion rates), and some of the fields may have more reserves than is initially known. In other cases, however, we may see only a decade of plateau production, and/or the plateau is an aggressive estimate (though obviously in every case we have well known oil companies signing up to do this).

So how fast is all this supposed to happen? Well, it's supposed to start in the middle of this year, as reported by Bloomberg:

Iraq will get about $200 billion a year from the development contracts awarded to international companies in the two rounds. The winning bidders will spend about $100 billion developing the deposits, al-Shahristani said after the auction ended in Baghdad yesterday. The work is scheduled to start about six months from the signing of the deals.and there are multiple press reports of al-Shahristani being quoted on achieving the 12mbd of capacity in six years. Six years is not a crazily short period for a large oilfield development in a flat desert - a fairly undemanding operating environment by oil industry standards (modulo the security situation, which I devote a section to later). If it was done that fast, and if we speculate that production climbs linearly from the middle of this year through the following six years, that would look as follows:

Note that the red line is capacity, which might or might not actually get used (depending on demand, prices, OPEC arrangements, etc).

Of course, Murphy will probably have his say here, and we might guess this process would take longer than the the currently planned six years - maybe a decade might be a better guess, even assuming no major relapse into violence and civil war in Iraq.

Indeed, initially I was sceptical that the country could physically export anything like that much oil any time soon -- present export capacity is only a few million barrels/day -- but plans are in progress to address that. According to a recent Dow Jones story Iraq Has "Master Plan" To Boost Oil Exports - Oil Min:

LUANDA, Angola (Dow Jones)–-Iraq is working on a "master plan" to construct new infrastructure to boost the country's oil export capacity, after the award earlier this year of 10 large contracts to international oil companies, the country's Oil Minister Hussein al-Shahristani said Wednesday.and

Shahristani also said new offshore pipelines would be constructed to replace ones that connect Basra and Khor al-Amaya terminals with crude deposits in Basra. A network of new oil pipelines will be also built in southern and northern Iraq.

Two floating oil terminals are already under construction at the main Basra oil terminal in southern Iraq and work on two others will start soon, Shahristani said, adding the four platforms would be able to handle 2 million barrels a day. Basra and the nearby smaller Khor al-Amaya port currently can handle up to 1.6 million barrels a day.and

"I expect these [floating] terminals to go through fast-track development to be ready in time when we have increased production," the minister said.

Foster Wheeler announced in February that it was awarded a contract by the Iraqi government for the basic engineering of new oil export facilities to supplement the existing Basra terminal. The new offshore facilities would include new single point mooring tanker loading buoys, together with oil pumping, metering and pipelines, to achieve an export capacity of 4.5 million barrels a day, Foster Wheeler said at the time.

The ministry is planning to build a new pipeline to go with the existing strategic pipeline that connects southern and northern oil fields.Similarly, Resource Investor reports:

The ministry will also build a new pipeline to go with the existing northern export pipelines that links Kirkuk oil fields with the Ceyhan terminal in Turkey, Shahristani said.

“The amount of work required for the infrastructure to handle such a massive production and to transport it and to export it is huge,” said Shahristani. He said a pipeline and export master plan will be completed soon after assessing the needs of the fields awarded for development.He at least seems to appreciate the problem. I'm sceptical that all these moving parts can come together in only six years, but clearly it can't be altogether ruled out either.

“There will be another port there and also a network of pipelines extended from the north of Iraq to the south and from the east to the west of Iraq to export oil from different areas,” he said. Such a move will diversify recipients, increase delivery to those already served, and allow it to separate the different qualities of crude instead of selling it as a concoction of one.

Hussain al-Shahristani, Iraqi Oil Minister

It's worth spending a little time on the question - who is this guy who apparently plans to turn the oil world upside down? I found a couple of profiles of him that are of interest. A 2004 profile in the Times of London, when al-Shahristani was a contender for prime minister, had this to say:Dr Hussain al-Shahristani, 62, a Shia Muslim nuclear scientist tipped to become the new Iraqi prime minister, is widely respected and regarded by many Iraqis as the best man for the job at the moment.and

While imprisoned and tortured at Abu Ghraib prison for 11 years under Saddam Hussein for "religious activities" he refused to help build a nuclear weapon for the country.

He had a dramatic escape from the notorious jail when it was bombed in the first Gulf War and fled to Iran with Bernice, his Canadian wife.

A devout Muslim from a prominent family, he has little political experience, but has close ties to Grand Ayatollah Ali Sistani, Iraq's most powerful Shia Muslim cleric whose support is essential for the viability of an interim government.

A diminutive bespectacled man, Dr Shahristani won a scholarship to Moscow before studying at Imperial College in London, where he graduated with a bachelor's degree in chemical engineering in 1965. He went on to get a PhD in nuclear chemistry from the University of Toronto in 1970.Some more color comes in a Wall St Journal piece Big Oil Ready for Big Gamble in Iraq:

There he also married the woman who typed up his dissertation, Bernice Holtom.

In 1978 he was appointed chief scientific adviser to the Iraqi Atomic Energy Commission. He was in a board meeting there the following year, when security officers turned up to bundle him off to be questioned.

He had thought he was respected enough to be safe in complaining to colleagues about the wave of executions and arrests of Shia Muslims. But he was sentenced to 20 years after another captive at security headquarters accused him of "religious activities". He was tortured by being hanged from the hands and having electric cattle prods applied to his genitals.

For a few months during his long imprisonment he was removed from the horror of Abu Ghraib, where he said that he witnessed the results of horrific torture.

Saddam's half brother and head of the secret police Barzan al-Takriti, who housed the scientist in a palace, asked him to help the regime build a nuclear bomb. Dr Shahristani said that he did not have the expertise. He was not believed.

His work had been in food safety, decontaminating mercury-laden grain. He was punished with ten years' solitary confinement back at Abu Ghraib.

But Mr. Shahristani, architect of the plan, is under attack from many quarters. Falling oil prices have triggered a budget crisis, and he is being blamed for not boosting production enough to make up the difference. Lawmakers and some oil officials, meanwhile, say the auction will give foreigners too much access to Iraq's resources. Mr. Shahristani also has been called to appear before parliament for questioning about alleged corruption and mismanagement at the ministry.and

"He should not continue," says Jabber Khalifa al-Jabber, secretary of the parliament's powerful Oil and Gas Committee. "Let someone who is qualified do the job....I can't name one accomplishment."

Prime Minister Nouri al-Maliki's spokesman, appearing earlier this month with the oil minister, voiced confidence in him and reaffirmed that the auction would take place as scheduled.

In a recent interview, Mr. Shahristani, 66 years old, says he has done nothing wrong, and that lawmakers critical of him have a political agenda. He says he looks forward to answering questions from parliament about corruption and mismanagement.

"I'm not a political animal, and I don't enjoy politics," he says. "The only reason I've accepted and continue with my responsibility is to protect the Iraqi wealth from unclean hands."

Deals in Iraq often are reached over cups of tea late at night, but Mr. Shahristani doesn't like schmoozing. In a capital built on patronage, he has denied plum jobs to longtime friends. He's earned a reputation as a stickler for rules, including cumbersome purchasing regulations that other oil officials blame for slowing down Iraqi oil development. He has refused even small gifts, such as neckties, from visiting oil executives, he says.

Around that time, Mohammed Baqir, a family friend who had helped Mr. Shahristani escape from prison, asked for his help in finding government jobs for relatives. Mr. Shahristani refused. "Shahristani's problem is he is too straight and clean," Mr. Baqir says. "As a politician, you need to be flexible."Both articles are well worth reading in full. It's hard to judge a person from thousands of miles away via a handful of news reports. But al-Shahristani has just held very transparent auctions in which he drove very hard bargains with international oil companies (there are multiple reports of oil companies initially refusing to bid, and then finally agreeing to Iraqi terms). Combining that with the reputation for probity and it seems that Iraqis may have been well served by their oil minister. Dr al-Shahristani will return to full time science next year following national elections in Iraq. In the meantime, he has certainly set a fascinating process in motion.

After a new government led by Mr. Maliki was formed in 2006, the prime minister named him oil minister. His new ministry, like other government agencies at the time, was overrun by militia members, and corruption was rampant, according to Mr. Shahristani and other current and former oil officials.

Over the next two years, hundreds of ministry employees were murdered or kidnapped. By the end of 2007, many top technocrats had fled the country, and various political parties had filled the ministry with patronage employees, according to Mr. Shahristani and the other officials.

Mr. Shahristani fired 250 members of the ministry's security staff thought to be militia members, and replaced top security officials with people he trusted. He turned over evidence of wrongdoing to the ministry's inspector general, and fired or transferred those suspected of malfeasance.

"Before, there was lots of interference in the ministry from political blocs, but he got rid of all that," says Abdul Mahdy al-Ameedi, head of the ministry's contracts department.

The purge stirred resentment. Some employees claimed they were wrongly targeted. Others accused Mr. Shahristani of being too by-the-book. He cracked down on absenteeism and introduced a card-scan check-in system. He scaled back bonuses.

Barriers to the al-Shahristani Plan

Violence and Civil War

Iraq still periodically makes the news for outbreaks of violence. However, the country does seem to be making progress in stabilizing. Obviously the most relevant index for our purposes is the fact that oil production has been increasing as documented above. Beyond that, the best compilation of data that I'm aware of for assessing this is the Brookings Institute Iraq Index. There are a ton of graphs there, and I just picked a few.Firstly we have the number of Iraqi civilian casualties of the violence:

As you can see, we are still having a couple of hundred casualties a month due to bombings etc. Iraq is not a normal country yet. However, the rate is massively lower than a couple of years ago, and is still trending down.

Attacks on coalition forces are also way down and still dropping:

As are deaths amongst the Iraqi security forces:

Iraqi public perception of the situation is improving correspondingly:

And although the data is unfortunately not up to date, the improvement in security for oil and gas infrastructure is clear:

However, there are still some problems:

(AFP) – Dec 19, 2009 BAGHDAD — Oil exports from northern Iraq have been halted by a sabotage attack on the pipeline to the Turkish port of Ceyhan, oil ministry spokesman Assem Jihad said on Sunday.All-in-all, it appears that if present trends in Iraq continue, it's quite conceivable the country could be stable enough to allow for major infrastructure investments such as the al-Shahrastani plan. Clearly, major oil companies are betting that this will be so since they are signing up to spend lots of money in order to produce oil for a fairly small per-barrel fee.

"A 55 kilometre (34 mile) section of the pipeline was damaged in the attack, causing a large oil spillage. Exports have stopped and technicians from the northern oil company (NOC) have gone to the site to survey the damage," Jihad told AFP.

The attack took place around 325 km (200 miles) north of Baghdad.

"We are asking the multinational forces to carry out more patrols to protect the pipeline, which was sabotaged for the fourth time in six weeks. We will not know when exports will resume until we have surveyed the damage," the spokesman added.

The pipeline usually transports between 420,000 and 450,000 barrels per day of oil, although it has the potential to ship 600,000 bpd, according to Jihad.

Total Iraq exports stand at around two million bpd of crude oil, and all its exports from the north flow through the pipeline to Ceyhan.

Improved security along the pipeline has limited the number of attacks in recent years. But after an 18 month period of calm, sabotage resumed on October 26.

Political Risks

The Iraqi parliament has never passed the famed oil law, and eventually Prime Minister Maliki and his oil minister got tired of waiting and just went ahead and auctioned the oilfield service contracts anyway, even without a really clear legal framework.There will be national elections in Iraq probably in March. This could lead to a government change and then the unclear legal status of the contracts could potentially be a problem.

My guess would be that with facts on the ground in the form of existing contracts under way, combined with the fairly beneficial terms of the contracts to Iraq and the transparent way the auctions were conducted with many players bidding, will mean that the plan will continue under a new administration. Having all that oil revenue is going to appeal to a government of any stripe. According to Reuters' reporting, most of the major players currently say they will honor the contracts:

Maliki's State of Law coalition, one of the main contenders in the March polls, will surely honour the oil deals should it hold onto the clout it currently enjoys.However, clearly there has to be some risk of a new government mishandling the country resulting in relapse into civil war, or deciding to declare all the al-Shahristani contracts illegal and renegotiate them, resulting in a big delay. However, informed observers are growing increasingly optimistic:

Some political groups say they will respect the contracts, but that could change in political wrangling during the formation of a new government after the March election.

The Supreme Islamic Iraqi Council (ISCI), which heads the Iraqi National Alliance, a coalition likely to be Maliki's main challenger at the ballot box, will also stand by the contracts, said Jalal al-Din al-Sagheer, a senior ISCI member.

"Of course it will be obligatory for the next government to honour these deals, regardless of reservations of any political entities right now. For that reason we advise that these contracts should be shown to parliament (before they are signed) so there is political consensus to ward off future problems."

Salim al-Jubouri, a senior member of the Iraqi Islamic Party, an important Sunni Muslim political group and frequent critic of Maliki's Shi'ite-led government, agrees.

"What this government signs will also be a commitment for the next government. They are signing in their official capacity (as government officials) ... and in the end it will be very difficult to go back on these agreements," said Jubouri, who is also the deputy head of parliament's legal committee.

"Maybe those individuals who signed can be held to account for their mistakes, but the deals will remain valid."

The Islamic Party is the biggest member of the main Sunni group contesting Iraq's March polls.

Iraq's ethnic Kurds are another of Iraq's key political players, and they are seen as powerbrokers and kingmakers because of their skilled manoeuvring.

"These contracts will hold because they are legal, and they have no connection with political differences between the government and parliament," said Feriyad Rawanduzi, spokesman for parliament's Kurdish bloc.

Fresh from a weekend trip to Iraq, U.S. Rep. Jim Marshall said he saw a strong sense of optimism that the country will survive as a democracy, and he witnessed an unprecedented effort to move equipment from Iraq to Afghanistan as a troop surge is readied.Obviously, there's high uncertainty, but it sounds to me more likely than not that something like the al-Shahrastani plan will occur, albeit probably with some delays.

This was Marshall’s 16th or 17th trip to Iraq, he said, giving him a series of snapshots of the situation there. He traveled briefly with Army Chief of Staff George Casey and met with Iraqi Prime Minister Nouri al-Maliki, as well as some of the country’s department ministers and American soldiers.

“There was a real sense of optimism this time around that I had not seen in prior trips,” said Marshall, D-Georgia. “You can’t guarantee this, but it does seem that the momentum (for democracy) is now to the point that it’s just not going to be reversed by al-Qaida ... or Saddam (Hussein) loyalists.”

Implications and Conclusions

The implications are complex, and not altogether clear. First, the impact on global oil production. If you believed, like me, that in the absence of this plan global production was now on a bumpy plateau, then the effect of the plan on global liquid fuel production is summarized in this next graph:Here I made a "Bumpy Plateau" scenario from a sine wave! Obviously, I'm not claiming to actually know when the bumps will occur, or exactly how big they would be, so the particulars here are just to illustrate the general idea of what I was expecting. However, as you can see, adding a large and rapid expansion of Iraqi production changes the picture in a qualitative way - we spend the next six-seven years in a serious expansion of global production, followed, presumably, by a new plateau at a higher level until global declines become serious enough to overcome efforts to develop new production.

The implications for oil prices at one level are simple: they will be much less than they would otherwise have been! However at another level, there is a lot of complexity. Firstly, given the speed with which global production is currently recovering, and the possibility of various delays in implementation in Iraq, there is some potential for the world to burn through current OPEC (mainly Saudi) spare capacity before the Iraqi expansion really gets going and cause another oil price spike in 2010/2011.

Once Iraqi expansion does begin in earnest the question becomes how the rest of OPEC responds. Right now, Iraq is not under a quota, but the last quota it had in 1998 was only 1.3mbd. Obviously, this is not going to work, and the Iraqi's have broached the subject, as Alsumaria reports:

Ministry of Oil called OPEC Organization to reconsider the share of its members according to the reserves of each of the same. Iraq Oil Ministry stressed that Iraq will bid in the upcoming years to export 12 million barrels of oil per day. Oil Ministry Spokesman Assem Jihad said in an interview with Alsumarianews website that trying to hoist Iraq oil output in the upcoming years is a natural right of Iraq as it owns huge oil reserves. Oil Ministry Spokesman called OPEC to grant Iraq its natural right in exporting crude oil so as its share becomes fair with regards to its oil reserves.This is obviously going to cause considerable concern:

Once Iraq more than quadruples its output capacity, OPEC will have to take steps to prevent Iraq from flooding the market, and force Baghdad to realign its supply policy with other members and stick to an output target. If not, the current level of supply and demand which OPEC has worked hard to achieve, which provides oil at a price it deems reasonable to producers and consumers - currently around $75 a barrel - will come under threat.however, it's not clear how much leverage OPEC really has:

"This will certainly cause ructions within OPEC because Iraq has huge resources and we can only assume that the Iraqis are going to pump as much as possible because they need the money," Judith Kipper, the director of the Energy Security Group of the Council on Foreign Relations in Washington, told Deutsche Welle. "If they get to the predicted number of barrels produced per day, this is really going to be a real issue within OPEC."

"If Iraq refuses to abide by the OPEC output level rules, then there's not much OPEC can do. Iraq may be land-locked but it has a couple of major pipelines which could be restarted and if relations with Syria and Lebanon ease then we could see Iraq pumping its oil to a Syrian or Lebanese port, bypassing OPEC countries."I see two general classes of scenario here. In one case, if the global economy recovers well and global demand grows nicely in coming years (the million barrels/day extra each year from developing countries, plus a bit more from the OECD), then it's quite possible the Iraqis and Saudis will be able to strike a deal and co-ordinate the Iraqi rise in production in such a way that oil prices remain in the $60-$80 range that has now become the new normal.

Hazhir Teimourian agreed: "Iraq flooding the market will be very bad news for Saudi Arabia and OPEC and neither could do anything to stop it," he said. "Why should Saudi Arabia be the only ones to export eight or nine million barrels a day and we have to stick to a lower OPEC output? In fact, Iraq could actually leave OPEC and go it alone. OPEC and Saudi Arabia will just have to take it."

On the other hand, if they are unable to work together effectively, prices could collapse. In particular if there is any material hiccup in global demand, there is a serious risk of a breakdown in OPEC discipline (such as it is) and a price collapse. For example, if there were a double dip recession in the OECD due to the aftermath of the global financial crisis, that could do it. Alternatively, if it's true that there is a Chinese asset price bubble and it burst and caused a Chinese recession, that could also cause a slump in global demand. Either way, the world could then find itself awash in spare oil capacity, which would be very likely to bring prices far below the new normal, at least for a while.

In general, the development of this Iraqi capacity, assuming it happens, seems to me likely to bring about an era a bit like the 1980s-1990s, in which energy issues retreat to the background for a while. I don't think prices are likely to fall as far or for as long as they did in those decades, but still I think there may be some qualitative similarities. From the perspective of the Iraqis obviously this plan is a good thing, and who can begrudge it to them? At the same time, in my view this is not really a good thing for the rest of us, as it allows us to postpone the inevitable for a little while longer. To use Richard Heinberg's party metaphor it's as though Dick Cheney and his crew managed to organize one last trip to the liquor store before everyone was too blind drunk to drive. Now the party can stagger on till everyone is really wasted. Sprawl in the US and Europe, sprawl-enabled-obesity, SUVs, growing Chinese auto-dependence, growing carbon emissions etc, all get a new lease on life.

In particular, just as the 1970s efforts at alternative energy were seriously damaged by the low oil prices of the mid 1980s and 1990s (as Alaska and the North Sea came on line), there is a risk that the current crop of biofuel and alternative energy companies, as well as hybrid and electric car efforts, will all suffer through an era of low oil prices, only to not be there when we really need them ten years from now.

I'm not saying for sure any of this will really happen. But it seems like a real risk, which I shall continue to track.

You put this together between 6 & 8am?

ReplyDeleteInteresting post. Nice to see you blogging again.

Multiple 6-8ams :-) Plus a chunk of the weekend.

ReplyDeleteDo the oil companies have to cover all production costs and turn a profit out of those meager fees? If so, one would think things might proceed gingerly. Easy to blow the budget.

ReplyDeleteDatamunger - supposedly the contracts have been structured to give double digit internal rates of return. I read 18% somewhere else that I can't find now. I think the idea is that operating costs are very low.

ReplyDeleteOne thing I wonder about though is what happens if we get significant cost inflation which tends to happen when oil prices go up and all producers try to develop everything at once (as we saw in 2005-2008).

No doubt the contracts are complex and could have various kinds of surprises and contingencies that aren't clear to us from news reports at present.

Great post! Well, I've read the 1st half and that was great; perhaps the 2nd half will suck...;)

ReplyDeleteAn excellent resource: Iraq Oil Forum. Actually more of a blog for journalist Ruba Husari. Try her interview with Mana’a Al-Obeidi director general of the NOC, for a start.

Q: Can NOC develop Kirkuk and Bai Hassan on its own?

A: Yes we can. I have plans to raise Bai Hassan capacity to 275,000 b/d without help from foreign companies. We are working on it and we can achieve that in a year or two, but it all depends on the equipment we need to import. As far as Kirkuk is concerned, according to our plan, we need to cut production there in a first phase and then increase it. We believe Kirkuk has a higher potential than it was thought but because we abused the field, we started having a water oil trap which we need to sort out first. We need a technical solution that allows us to drill straight to the oil, not to the water.

Finished reading. Kudos.

ReplyDeleteHere's a spreadsheet (Open Office .ods format) you may find handy. It's discovery data from AAPG's EXPLORER bulletin, every January they have a roundup of last years' finds. Except in 2003 and 2005 for some reason, those years they just published a smattering. Other years have pretty big tables, just the highlights but that amounts to quite a bit - 2004 has 355 entries. I've written the editors asking if they can provide data for the missing years. Posted the link last night at Rapier's excellent article on Doomaphilia, which you play a leading role in, Stuart.

Iraq’s oil and the future was a very interesting article, Kjell Aleklett summarized a chat he had with Dr Issam A. R. al-Chalabi, ex-everything in the Iraqi oil industry, including oil minister. In particular he says he was never leaned on to inflate reserves during his tenure, which ended in 1990. Contradicting this - ? - here's an NYT article from '89 where they were claiming 280 bbo URR: Iraq Expected to Seek Increase in Its Oil Quota - NYTimes.com

KLR:

ReplyDeleteIraq Oil Forum does look like a great reference, but looks like you have to be approved by the moderator to even read the articles, so I await my approval...

On Robert's article - you might not be surprised that I don't see the history quite the same way :-) I will respond at length at some point.

Thanks particularly for the Kjell Aleklett article, which somehow my Googling around had not discovered. I must admit after investigating the situation, I'm willing to countenance the possibility that Iraqi reserves are not overstated. Given that detailed investigation on the fields where wer have been able to check (North Ghawar and Abqaiq) suggests Saudi reserves are, and the reports on Kuwaiti overstatement from a few years back, and the fact that Iraq was the first of the step functions in the 1980s, one possible interpretation is that the Iraqis legitimately increased their reserves, but then everyone else responded by more-or-less fraudulently raising theirs in order to avoid an Iraqi quota increase.

The situation is too murky to be sure.

Stuart:

ReplyDeleteI realize your article is speculative etc but it shifts you a little toward Fatih Birol's date for peak of conventional oil production (2020). Convergence.

However, Iraqi historical production is very jagged. Shit happens in Iraq. Was it all because of the Baathist regime's behaviour? Or are there deeper currents that pretty much guarantee instability. e.g. It could prove difficult to prevent another strong man from emerging. Even for economic reasons, neighbours might prefer an Arab Chavez ran Iraq (lower and less efficient production) and have the wherewithall to help that scenario and avoid a democratic feeding frenzy.

I think I'll continue to bet against such a massive production hike. But it's great that you are highlighting it.

This a very interesting and provocative analysis. But I'll go along with Datamunger's skepticism that Iraq could accelerate production to 12 mbd in 6 or 7 years. Wouldn't this be an unprecedented rate of increase? It took the UK and Norway 25 years to reach maximum production.

ReplyDeleteHere's another article about Al-Chalabi, where he discusses the impact of poor reservoir management on Iraq's fields: Former Iraqi oil minister calls for Iraq production cap, reservoir repairs | Energy Bulletin. One striking figure is that Kirkuk's 8.7 bbo is mixed in with 1.48 of garbage injected post-1991: fuel oil etc.

ReplyDeleteThe closest parallel to this situation might be Texas, whose fields also suffered from bad management early on, only to be treated more sensibly later on.

Datamunger, Mike:

ReplyDeleteI obviously agree with you that there is considerable reason to be sceptical about the timeline. There could be contract negotiation delays, inability to get critical supplies and materials in-country fast enough, failure to develop the export capacity fast enough, etc, etc.

The questions of political stability are entirely a judgement call - who knows really. All we can say is that at the moment the trend is pretty good.

However, it does rather look like the oil is there. And a bunch of big and reputable companies just signed up to produce it.

One interesting thing that I just learned over at Iraq Oil Forum (which is a fantastic resource) is that the companies where required to guarantee the plateau for only seven years. So Iraq is definitely not taking a terribly long term perspective on these fields. Another interesting thing is that, for instance, the second bid on Rumaila led by Exxon actually had a *higher* plateau of 3.1mbd, rather than the 2.85mbd of the BP bid. However, BP et al would meet the ministry's maximum fee guidelines which Exxon et al refused to do. The minstry's maximum fees were based on their estimates of company IRR not to exceed 15-20% depending on field.

A useful compendium of recent data on Iraq (since the war began) published by the New York Times a few hours ago.

ReplyDelete>>SS: However, it does rather look like the oil is there.

I have to confess to being shocked and awed by this possibility. And by fact that we live in a world where grand designs of the powerful may be realized (at huge cost).

Incredible post, Stuart.

ReplyDeleteThe last picture really says it all, doesn't it? Should be captioned, "I love it when a plan comes together."

Confirms my view that the Iraq War was really about pushing the 'cliff' of Peak Oil back, by any means necessary.

As Mr. Cheney said, "The American way of life is not negotiable."

I guess we should all say, "Thanks, Dick."

Stuart,

ReplyDeletegreat post! What is the chance that oil coming from CNPC projects (3,5 MB/day) will never be available on the world market? I think that what we will see in the coming years is

* old world Peak Oil, we will have to do with what we've got and live with the depletion of old fields.

* China's continued growth, as they are securing huge amounts of "cheap" oil now.

Of course we "old worlders" will continue to profit form their cheaply produced goods.

Greetings

Kweksma - at least as long as the world is generally peaceful, I don't think it would make any difference if the CNPC oil was directly sent to China. It's got to go somewhere, and wherever it goes, that place is going to need less from somewhere else, and the overall effect on the supply/demand balance, and thus on prices, will be the same.

ReplyDeleteAlso, in this case, the oil companies, including CNPC, are all getting a fee for service to produce the oil. Iraq is in control of how much the oil gets sold for, which I assume will be to the highest bidder, if their behavior so far is any guide. So it doesn't seem likely to me that China will be getting any cheap oil from Iraq (except in the sense that Iraqi oil is going to lower world prices generally).

The key here seems to be the bumpy plateau - along with the time line.

ReplyDeleteIf we go along with the recent IEA whistleblowers' contention that decline rates are higher than stated, and overall decline of older fields was thought to be around 4.5 mmbd already, so who knows how high it really is, it's not very realistic to expect another ten years of bumpy plateau, is it?

That 8 mmbd of Iraqi oil is eaten up in only two or three years. Saudi supposedly has about 4 mmbd of spare capacity, and that's pretty much it for them according to both Aramco and al Husseini.

If we take a decline rate of, say 5.5%, and a modest increase in demand due to BRIC countries of just .005, we need more than 40 mmbd of new oil by 2020.

You have to see an additional 28 mmbd coming from somewhere, in a timely fashion, for all this to work out.

And that's just keeping us even, which is, itself, economically unviable in a profit and growth-driven system.

Even if the most optimistic scenario unfolds in Iraq, I fail to see how it mitigates problems much.

Am I missing something?

ccpo - I think you are confusing the net decline rate and the gross decline rate. The net decline rate for the world has been about zero for the last five years or so - the industry has just about replaced declines each year.

ReplyDeleteIraq's projections are extremely lofty. Talk about pie in the sky. I wouldn't be betting on sustained cheap oil prices anytime soon.

ReplyDeleteLike Stuart mentioned above, it takes time, investment and most of all political stability in order to bring that much new production online.

It is worthwhile to note that since the release of this article - and this is no assault on the author - Iraqi oil production has seen very little in the way of production increases, and has actually declined recently.

ReplyDeletehttp://3.bp.blogspot.com/-z02BBzOPfYM/TZDvzVJBvsI/AAAAAAAAK44/7qZEn4OVhJo/s1600/iraqstatusmar2011.jpg

That chart shows little to no increase over the past year and a not-so-insignificant drop from a peak in January 2011.

If the ramping up of production takes too long, it will only sustain current levels of production, rather than increasing global production. Decline of global fields is only likely to accelerate in the coming years.

JR:

ReplyDeleteI'm not sure what the source of your numbers is, but the official agency data show that Iraqi production increased recently. My most recent graph is here, and doesn't show March data, but it actually increased again slightly. I think we are only at the beginning of the ramp up (though how fast and how high it will go are certainly hard to call).

Hi Stuart

ReplyDeleteNow that we're four years down the track from when you wrote this post it might be worth a revisit?

Clearly Iraqi hyper optimism hasn't come to pass so far. They're actually below those exptrapolations of the trend line in your chart and above ground issues don't look to be improving (if these are the only problems). Furthermore the unexpected US Shale resource has been unable kick oil off the price plateau, despite much reported triumphalism.

In fact the global supply/demand balance still looks very fragile and my pick for the next repricing looks like up not down. Are the KSA and FSU pumping as fast as they can? Probably, in other words there may be some missing production from Libya and Iran currently but no spare capacity as such to plug the gap soon to be caused by the decline in US Shale.

The oil the US is currently not importing (because of Shale and demand destruction) has found ready markets elsewhere and many in the US will be surprised to find it no longer available at the current price when they return to market in a year or two.

Essentially this century has seen oil once imported by the OECD now transferred to the non OECD. This looks structural rather than a phase. Europe is unable to buy it and the US is currently using more local sources, of which the Canadian one has a future but not so the Bakken and Eagle Ford.

Interesting times. It looks like your description of the world being stuck on the plateau is looking much more accurate than the possibility that Iraq (or Shale) can return the oil market to the 80s/90s oversupply situation and lower prices. This is because of the global spread of western-like higher oil demand economies, especially in Asia. Demand in the west, and particularly the US, no longer sets the price. This is new.